The Future Banking Working Group (FBWG) invites you to our upcoming session on “Payments and The Future of Money” — a tactical workshop exploring how digital innovation is reshaping payments and currency.

In this interactive session, we’ll explore:

- The macro shift away from cash and the rise of digital payment instruments from CBDCs and stablecoins to tokenised deposits.

- How blockchain and distributed ledger technologies are powering next-gen payment systems.

- The growing size and impact of digitised assets

- Why digital currencies are critical from cost reduction to risk management and consumer choice?

- The institutional uptake of digital assets and the role of digital payments in reducing systemic risk.

- Regulatory challenges, the urgent need for re-education, and what tokenisation means for banks’ assets and liabilities.

- A look into the future: could your next bank account be fully digital?

- How to stay current through resources like Digital Bytes.

Agenda (SGT)

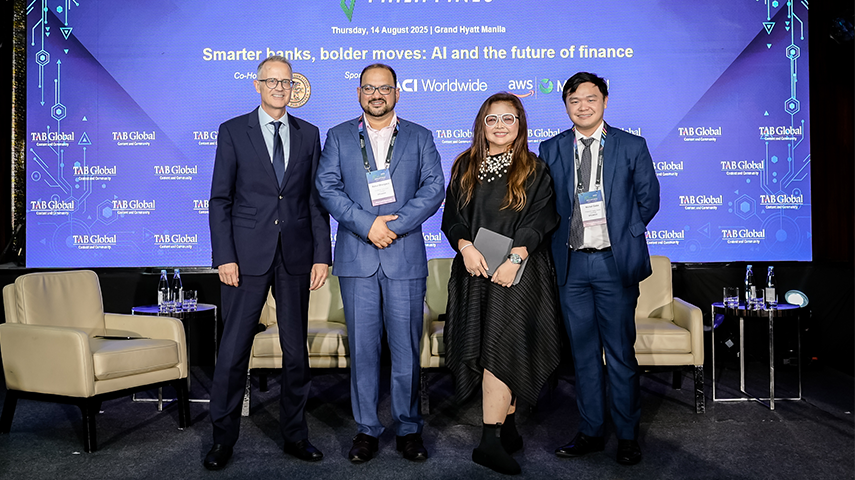

- 11:00 PM – 11:20 PM: Introduction of Digital Assets by Emmanuel Daniel, Founder of TAB Global and Urs Bolt, Chairman, The Banking Academy

- 11:20 PM – 11:50 PM: Presentation by Jonny Fry, Former Group Head, Digital Assets Strategy, ClearBank, alongside David Parsons, Chief Technology Officer, NiftyOne

- 11:50 PM – 12:00 AM: Q&A

Industry Experts