This year’s winners of the TAB Global Financial Technology Innovation Awards show the industry’s shift from surface-level digitisation to structural transformation. The need for mobile-first experience has prompted banks to invest in seamless onboarding and intuitive digital interfaces. TABInsights data reveals that mobile is now the primary digital channel for about 40% of APAC banks.

Banks are now embedding intelligence, enhancing resilience and advancing sustainability. They are repositioning themselves as real-time platforms delivering personalised journeys. These shifts are interconnected: AI adoption is accelerating, which in turn demands modernised technology stacks and stronger data foundations.

Artificial intelligence (AI) scales into core banking processes

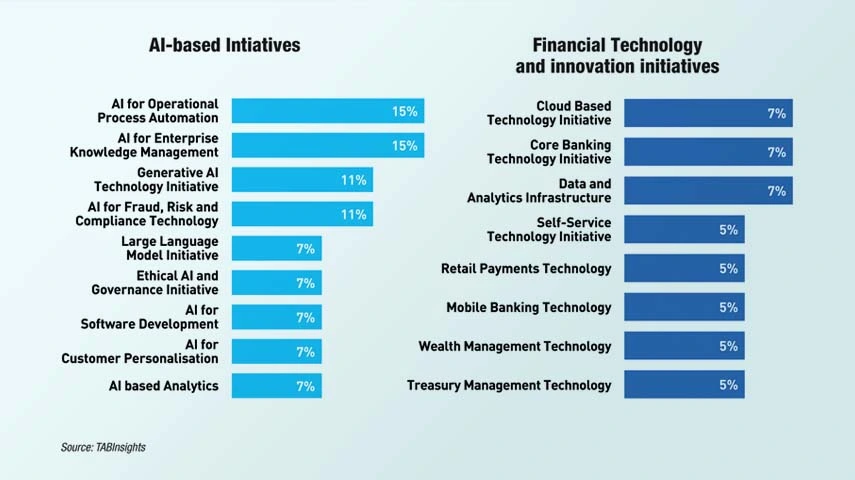

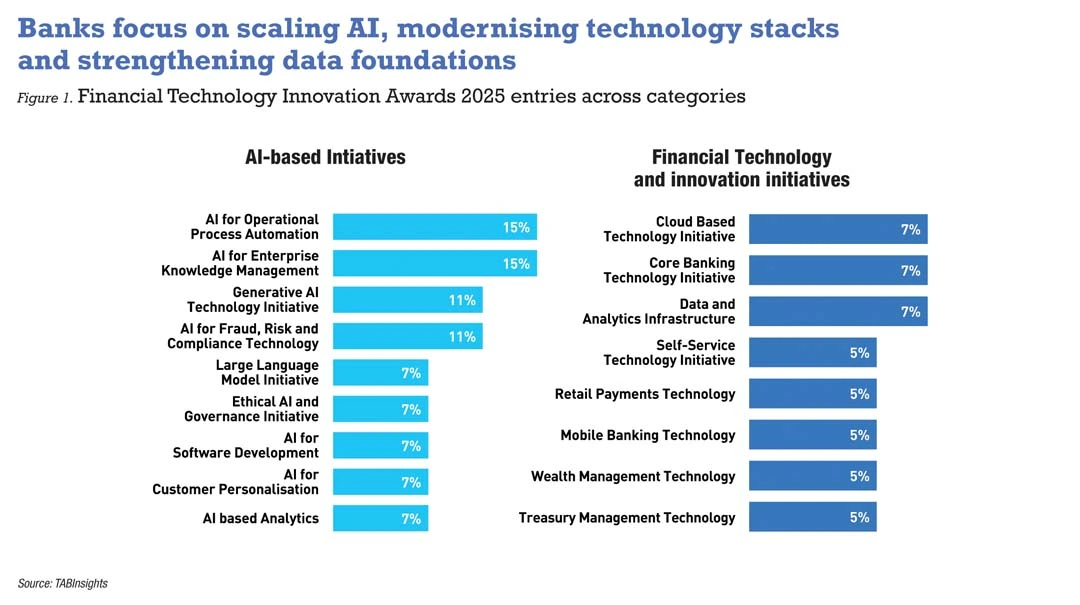

Banks are deploying role-specific and domain-optimised models across functions, especially compliance, customer engagement and operations. The adoption of generative AI (GenAI) and large language models (LLM) is accelerating.

OCBC has scaled up its AI capabilities with hundreds of models, including 30 GenAI models and a recommendation engine, boosting personalisation in sales and driving revenue. At Kasikorn Bank, AI initiatives extend to fraud detection, regulatory compliance and human resources, supporting thousands of employees. The bank also launched a domain-specific financial LLM and a multi-agent platform. These have doubled campaign conversion rates, reduced manual know your customer (KYC) work by 95% and cut asset appraisal time by 90%. ICBC’s sector-specific LLM now covers over 200 scenarios in credit, operations and customer service, and autonomously resolves 90% of customer queries.

Beyond efficiency, AI is augmenting creativity and decision-making, from generating investment recommendations to automated risk management. At the same time, hybrid human–AI collaboration is reshaping the workforce. Governance is becoming a critical differentiator, with banks like China Construction Bank investing in an enterprise-wide, end-to-end model risk management platform that ensure transparency and reduce model-related risk events.

AI is scaling rapidly, but its success depends on the strength of the underlying architecture. Banks are modernising their technology stacks and data foundations in parallel to ensure AI adoption is not only effective but also sustainable.

Structural shift to scalable, modern platforms

Challenges in legacy systems around speed, scalability and complexity of innovation make platform modernisation a strategic priority. Banks are adopting cloud-native, modular systems to scale computing power and using an application programming interface (API)-first to integrate across the ecosystem.

Some banks are completely replacing their core as well. Fusion Bank rebuilt its core in under a year using a distributed, vendor-agnostic architecture, improving time to market and saving costs. Vietnam’s MSB implemented a comprehensive core banking transformation spanning retail and corporate functions, including teller systems, trade finance and payments to support higher availability and throughput.

Cloud-led scalability is becoming critical as transaction volumes rise. Techcombank migrated its major retail and corporate systems to cloud, enabling on-demand scalability, reduced costs, faster time to market and enhanced availability. Today, it onboards 55% of new customers digitally, and 97% of transactions are processed online. In another example, Clearstream Fund Centre in Luxembourg launched a cloud-native, API-first platform that integrates custody, foreign exchange (FX), credit and settlement into a unified, real-time infrastructure.

Payments and transaction infrastructure are being unified into enterprise-grade platforms designed for straight-through processing and cross-border readiness. In addition to an agile and integrated tech stack, banks need the right data foundations to support insight-driven banking.

Real-time data redefines decision-making

Banks are adopting streaming-first architectures, where data is owned and governed at the domain level. This enables faster insights and ensures accountability.

Security Bank’s streaming-first architecture and data mesh accelerate product launches and improve responsiveness. Institutions are harnessing real-time data to deliver contextual and hyper-personalised services. OCBC re-platformed its legacy data warehouse into a real-time, analytics-ready infrastructure using an open-source stack and data mesh. This reduced data provisioning times by 80% and saved costs.

The broader transformation is also cultural, shifting from reactive to predictive, anticipating needs, shaping journeys and guiding decisions in real time.

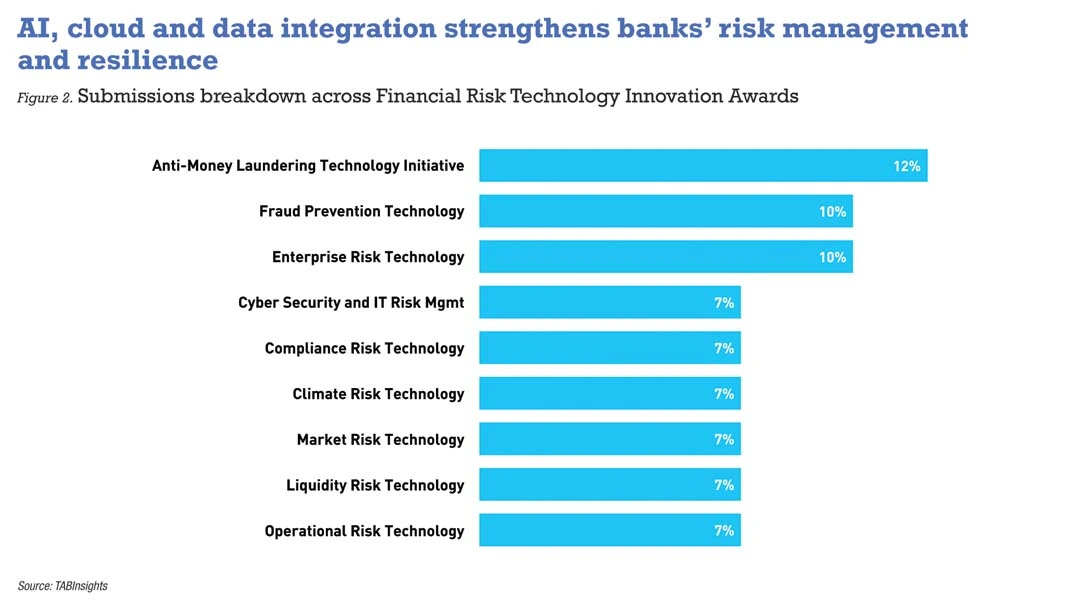

Risk technology shifts from compliance to predictive resilience

Banks are investing in stronger resilience and focusing on AI-driven risk management. Risk is being reimagined with predictive systems that build trust, sharpen decision-making and agility to respond.

Ant Group has built an integrated anti-money laundering platform that combines AI with graph computing to detect complex transaction anomalies. This reduced compliance preparation time by 30% and improved decision-making speed by 90%. Bank of Beijing applied AI and big data for post-credit monitoring, using early warning triggers and risk-based inspection for proactive oversight, enabling 97% of post-loan reports to be completed automatically. Meanwhile, Kasikorn Bank re-engineered debt collection through dynamic, AI-based segmentation, while banks increasingly embed automated verifications to streamline due diligence and compliance.

As resilience strengthens, banks are also extending their reach through ecosystem-level collaboration and interoperability.

Greater interoperability and ecosystem shifts

Banks are moving beyond siloed systems towards infrastructures that connect seamlessly across borders, asset classes and counterparties. Distributed ledger technology (DLT) is entering production. For example, J.P. Morgan’s Kinexys platform enables multicurrency payments, tokenised collateral and real-time on-chain treasury operations. Blockchain is increasingly embedded in settlement, liquidity management and tokenised asset applications.

Meanwhile banks are integrating into ecosystems across client workflows and industry platforms through collaborations. Global networks are expanding access through new rails. Thunes, for instance, has introduced stablecoin liquidity, QR payments in China and pay-to-wallet services via Swift, demonstrating interoperable ecosystems across the sector.

Sustainability becomes a structural priority

Banks are hardwiring sustainable practices into enterprise systems as regulators issue advisories. In its 2024-2025 Sustainability Report, Monetary Authority of Singapore (MAS) reaffirmed the need for stricter disclosure standards, climate resilience and stronger policy and regulatory measures.

Banks are strengthening tech enabled solutions. Taipei Fubon Bank’s climate risk management system, for example, has automated financed emissions reporting in compliance with regulatory standards. It uses cloud computing, real-time data streaming and automated workflows, reducing reporting time by 96% and enabling monthly carbon disclosures. At OCBC, AI applications have reduced ESG data extraction time by 97%. These strategies demonstrate that sustainable finance is now embedded as a pillar of the modern banking model.

Leading banks now leverage platforms that learn in real-time, built on modern cores for agility and interoperable rails for ecosystems. They are embedding AI at scale across operations, advancing towards compute-intensive capabilities that adapt and evolve continuously. They focus on streaming-first data with domain ownership, governed AI in workflows and predictive risk as a control plane. Banks that assemble this technology stack will not just set the tempo of markets, but define the industry’s next era.