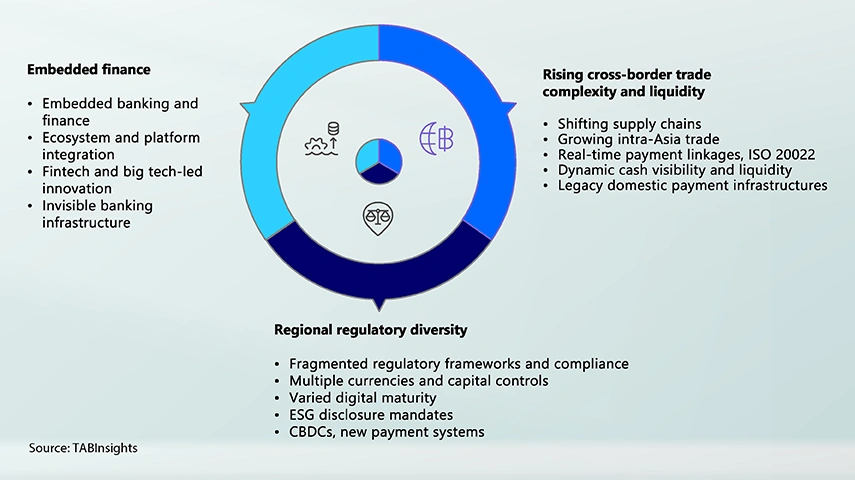

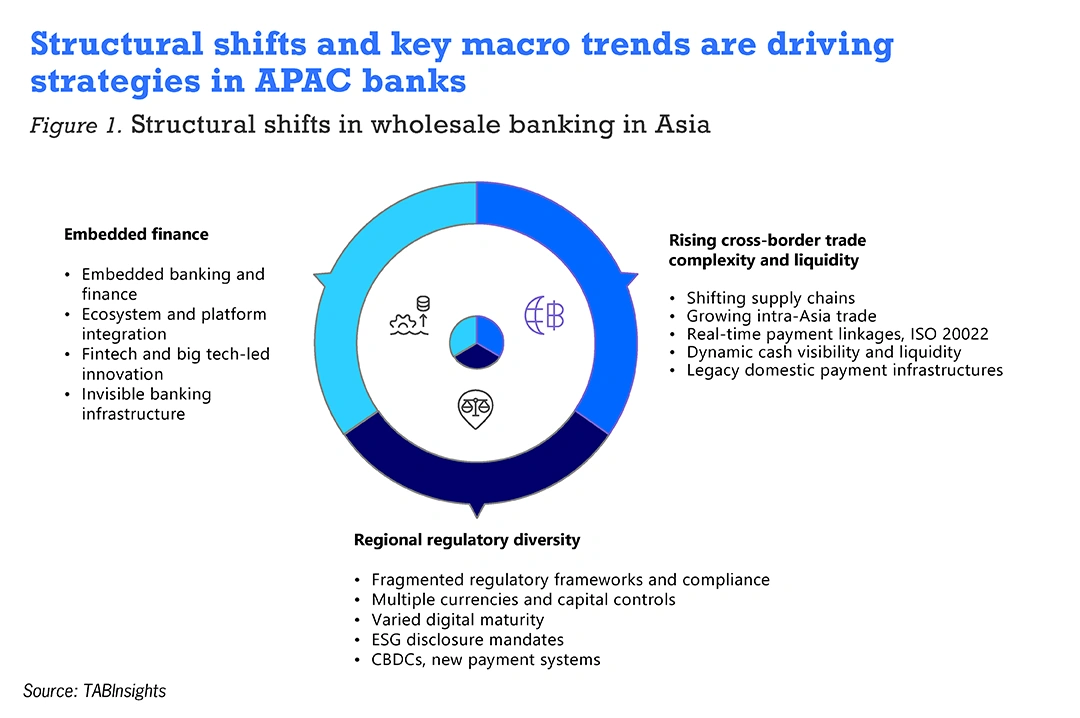

Asia Pacific’s wholesale banking industry is undergoing a structural transformation. Rapidly shifting trade corridors, rising intra-regional investment and an increasingly digital-first corporate mindset are reshaping how banks serve their clients. Corporates now expect real-time liquidity visibility, seamless cross-border payments and financing aligned with sustainability goals—not as differentiators, but as baseline expectations.

TAB Global’s recent white paper, Building the Future-Ready Wholesale Bank, jointly developed with FIS, based on in-depth interviews and case studies, highlights emerging strategic imperatives.

Asia Pacific’s wholesale banking at an inflection point

Asia’s growth is underpinned by resilient supply chains, rising intra-Asia trade and an increasingly digital-first economy. According to the Asian Development Bank, digital payments across the six largest ASEAN economies are projected to exceed $1.2 trillion by 2025—proof that the region’s economy is moving toward fully embedded financial connectivity.

This expansion is unfolding amid regulatory diversity, currency volatility and uneven market maturity. Yet reforms such as the legal recognition of electronic trade documents, expanded oversight of digital assets and payment-system interoperability—for instance, Singapore’s PayNow and India’s UPI—are driving greater transparency and connectivity.

Meanwhile, sustainability has shifted from niche to necessity, as regulators tighten environmental, social and governance (ESG) disclosure norms and promote green finance frameworks. The convergence of trade growth, digital integration and sustainability mandates is creating a proving ground for next-generation wholesale banking—one built on intelligence, openness and resilience.

From incremental digitalisation to structural reinvention

The white paper finds that leading banks are no longer digitalising transactions; they are rebuilding the core as this shift goes beyond channel digitisation to re-engineer the foundations of wholesale banking. According to TABInsights’ Transaction Finance Survey 2025, leading institutions have achieved an average 94.1% straight-through-processing (STP) rate, signalling progress in automation and reconciliation.

However, the real inflection point lies not in efficiency gains, but in rethinking infrastructure, data and operating models to make banking integrated, intelligent and sustainable. This transformation is being defined by three imperatives: embed, orchestrate, and accelerate — a framework for building the future-ready wholesale bank.

Together, these imperatives form the blueprint for APAC’s next phase of wholesale banking transformation—a shift from incremental digitisation to structural reinvention, where integration, scalability and intelligence converge to deliver real-time, resilient and sustainable value.

Embed: Banking built into the client ecosystem

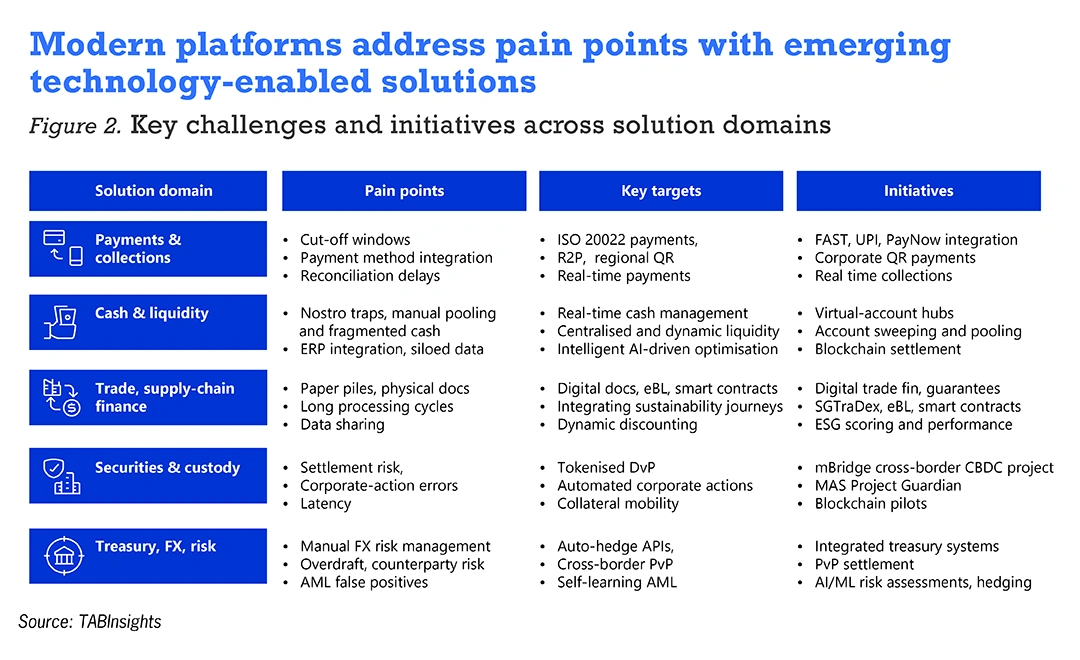

Embedding begins with integration, where banks are bringing finance to where clients operate—within their systems, marketplaces and supply chains. The technology shifts towards API-first integration connect banking directly to client digital ecosystems.

Banks position themselves inside client workflows through API-led treasury integration with enterprise resource planning (ERP), allowing corporates to automate reconciliation, manage liquidity in real time and reduce friction. They are expanding virtual accounts (VA), unique sub-ledgers that automate receivables matching and liquidity segregation. Adoption of ISO 20022 and cross-border fast-payment linkages are establishing a regional standard for messaging and data quality

Vietnam’s Techcombank exemplifies this transformation. Through ERP-integrated treasury solutions and VA platform it has embedded payments, liquidity tools and reconciliation within client workflows. It automated receivables reconciliation, reduced manual processes, and improved reporting accuracy, resulting in its VA platform witnessing an eleven-fold increase in volumes and four-fold rise in value over 2024. Its C-Cash Treasury platform delivers real-time forecasting; more than 45 machine learning (ML) models enhance fraud detection and personalisation. As a result, in 2024, 91% of transactions are conducted digitally, with a 50% rise in e-banking volumes.

Ecosystem partnerships are deepening across the region. In Singapore, Maybank collaborated with a digital procurement-to-payment platform, to expand SME access to supply-chain financing by leveraging platform transaction data for working-capital optimisation.

Mizuho Bank’s partnership with BNY granted reciprocal access to Relationship Management Application networks, extending its reach across markets. Its fintech partnership in India integrated gateways, point of sale systems, QR codes, and the Electronic National Automated Clearing House (eNACH) enabling clients to optimise their collection processes.

These initiatives demonstrate how strategic partnerships and embedded connectivity allow banks to extend their reach and operate seamlessly within client ecosystems across regions. These also reflect how embedding transforms banking from a destination into an invisible layer of enterprise infrastructure operating within client ecosystems.

Orchestrate: Modular platforms driving regional and digital scale

As corporates expand regionally, banks must unify experience and infrastructure across multiple markets while preserving local agility. The orchestration imperative focuses on modular, cloud-native, and event-driven platforms that deliver scale, resilience and faster deployment.

Banks are moving decisively to scalable cloud-native systems, microservices-based platforms for increased flexibility and event-driven frameworks that respond instantly to real-time activity and scale across markets. With growing cyber and operational risks, zero-trust security (no implicit trust), continuous verification (ongoing authentication), and active-active systems (simultaneous backups) are becoming the baseline for operational continuity.

Techcombank’s cloud-native, API-enabled stack supports consistent solution deployment across client platforms. Mizuho Bank is overhauling its trade core banking system and piloting a Regional Integration Hub in two countries.

Maybank’s Maybank2E platform unifies cash, trade and supply-chain finance across Malaysia, Singapore and Indonesia, offering corporates a single real-time view of financial positions. The bank addressed legacy infrastructure through technology partnership modernising its cloud, AI and security capabilities. These contributed to a 6.5% year-on-year current account savings account (CASA) balance growth and over 13% increase in corporate clients on M2E in Malaysia in the first half of 2025.

Bangkok Bank demonstrates a similar architectural and digital shift. Its iTrade platform streamlines trade finance offering an integrated experience for importers and exporters, providing real-time dashboards. Leveraging its network across 12 Asian markets, the bank supports local-currency settlements in RMB, IDR and MYR and participates in national initiatives such as PromptTrade and the National Digital Trade Platform to enhance trade data exchange and efficiency.

These examples highlight how orchestration transforms technology into a strategic lever for growth, enabling regional consistency, local innovation and ecosystem connectivity.

Accelerate: Intelligence at scale through AI and analytics

Acceleration is about intelligence at scale. Banks are deploying AI, analytics and automation to move from reactive to predictive decision-making—forecasting liquidity, detecting anomalies and managing compliance dynamically.

Leading banks focus on AI-first decisioning and scaling intelligence. Predictive models enhance risk, fraud and liquidity optimisation, supported by data-mesh architectures (domain-owned, governed data layers). There is increased adoption of MLOps frameworks to develop, deploy and monitor ML models and AI governance policies for transparency and compliance. ESG-linked supply-chain and green trade finance instruments — from green deposits to letters of credit — are now integral to client solutions as they accelerate sustainability journeys.

Mizuho Bank illustrates this acceleration in action. The bank rolled out a Client Insights Platform leveraging transaction data to anticipate client needs — from forecasting forex requirements to detecting anomalies signalling attrition risk. Its generative AI solution, integrated with retrieval-augmented generation (RAG), automates the process of responding to proposals for corporate cash management mandates. The bank is piloting blockchain for settlements and exploring tokenised deposits to improve inter-branch reconciliation. It also launched a Green and Sustainable Trade Finance Framework and issued its first green letter of credit under Singapore’s eGuarantee@Gov programme. In 2024, trade finance revenue grew 22%, with CASA deposits up 10%.

Together, these initiatives show how acceleration merges AI-driven intelligence and sustainability, making resilience and foresight core capabilities.

Banks are modernising their payment, trade and treasury solutions by embedding these three principles of embedding finance, orchestrating platform and accelerating intelligence. For corporates, this means API-led payment integration for instant reconciliation, real-time liquidity pooling across currencies and digital trade platforms powered by data, blockchain and sustainability frameworks.

These developments also mark a deeper cultural shift fostering a cross-functional innovation culture. Product, risk, compliance and operations teams now collaborate around shared data foundations, accelerating iteration, innovation and decision-making.

The road ahead: From systems to ecosystems

The next phase is about industrialising intelligence, scaling execution, and orchestrating ecosystems at speed. Institutions that delay risk higher costs, slower innovation, and lost mandates in an increasingly real-time and interconnected marketplace.

- Establish real-time digital foundations: Modernise payment, trade and liquidity systems using ISO 20022 standards, API-first design and cloud-native architecture to enable instant processing and embedded compliance.

- Orchestrate scalable ecosystems: Build modular, interoperable platforms that connect banks, corporates and fintech partners across borders, supporting local innovation and regional consistency.

- Turn data into intelligence: Create unified, governed data layers and frameworks to industrialise AI for forecasting, fraud detection and sustainability analytics.

- Scale pilots to production responsibly: Operationalise AI with robust model governance, explainability and MLOps, while preparing for emerging technologies. Move blockchain, tokenised deposits and programmable finance from pilots to production under strong governance and resilience controls, as the next layer of market infrastructure. Embed privacy, ethics, and resilience by design.

- Foster culture as a multiplier: Embed cross-functional collaboration, agility and accountability across business and technology teams so innovation becomes an enterprise-wide capability.

Those that act on these priorities will lead the next phase of wholesale banking in Asia Pacific — defining not just how finance connects to the economy, but how the economy itself connects.

For more insights and detailed findings, download the full report here.