Geopolitical instability and renewed trade tensions are disrupting global supply chains, causing delays, increased costs and heightened uncertainty. For corporate treasurers, these disruptions reduce visibility into liquidity and cash flows, complicating the management of working capital. Sanctions risk further exacerbate foreign exchange (FX) volatility, prompting corporate treasuries to reassess their hedging strategies.

In response, treasurers are adopting more cautious and resilient approaches – diversifying cash holdings, limiting exposure to riskier counterparties, increasing cash buffers and consolidating liquidity within home markets or functional currencies. The current environment, marked by declining interest rates and heightened FX volatility, has accelerated the need for enhanced visibility, and smarter FX hedging solutions. The TABInsights Asia Pacific Cash Management 2025 Survey was conducted against this volatile backdrop.

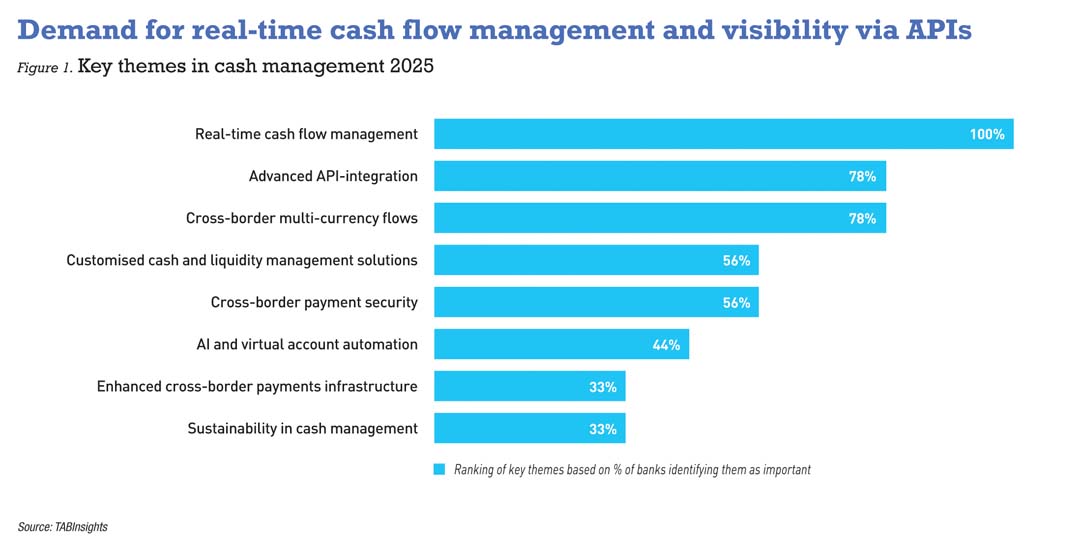

Amid this greater need for agility, treasury teams are increasingly relying on application programming interfaces (APIs) and artificial intelligence (AI) to monitor cash positions and risk exposures, resulting in faster, better-informed decision-making. The demand for intelligent treasury solutions – particularly for real-time cash flow management – continues to rise. Enabled by API integration, customised solutions and virtual accounts, these solutions help reduce costs and optimise liquidity by centralising cash flows.

Notably, 100% of respondents to the TABInsights Asia Pacific Cash Management 2025 Survey identified real-time cash flow management as a top priority, underscoring its growing importance in today’s treasury environment. The survey is conducted annually between January and June as part of the TAB Global Transaction Finance Awards Programme, capturing insights from over 50 banks into key trends and best practices in cash and treasury management in the region.

Real-time treasury management enabled by API integration

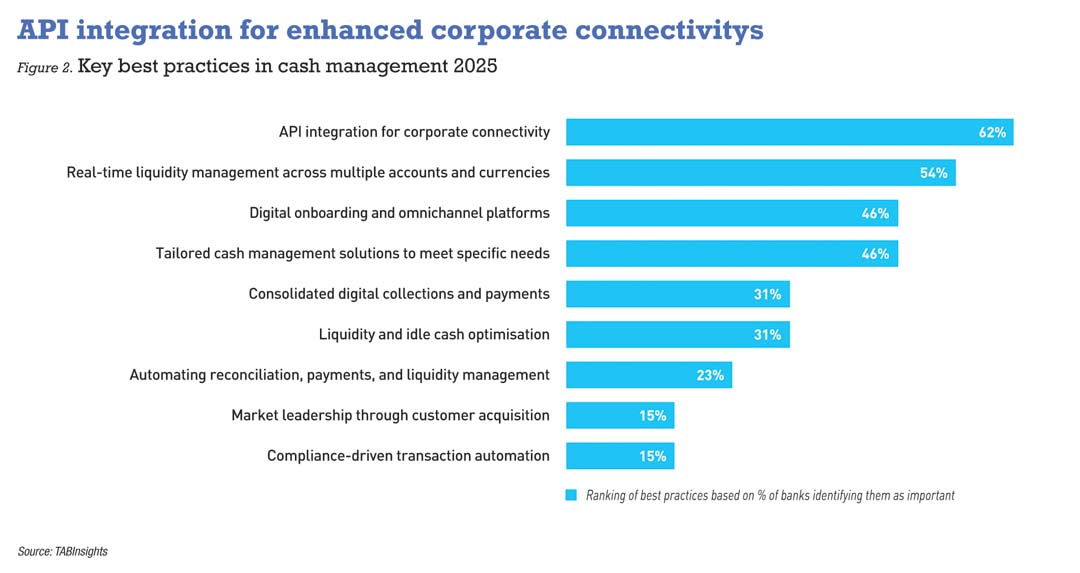

The shift to real-time treasury management is driven by API adoption. APIs facilitate seamless data and transaction exchanges across systems, both within an organisation and with external partners. In corporate treasury, API integration streamlines financial processes, enhances decision-making and improves liquidity control.

Building on last year’s survey, real-time treasury and cash flow management remains a prominent theme. The rapid adoption of APIs across payments, reporting and collections is enabling continuous visibility and driving stronger operational efficiency.

The TABInsights Asia Pacific Cash Management 2025 Survey also found that 62% of respondents identified API integration as the top priority for enhancing corporate connectivity, while 78% ranked advanced API integration as the second-most critical theme for ensuring secure client communication. These findings highlight how API-driven solutions enhance transparency and efficiency.

API integration unlocks new treasury services

As multinational corporations demand API connectivity, banks are introducing services previously not possible with legacy systems. Across Asia Pacific, several banks have developed dedicated corporate API suites, enabling businesses to access real-time account balances from multiple banking providers, time zones and geographies, providing a holistic view of liquidity.

Deutsche Bank’s dbX platform exemplifies this evolution. As a fully integrated correspondent banking ecosystem, it brings notable enhancements to liquidity and treasury management for corporates and financial institutions (FI). One of its key features, dbXtreasury, provides intraday liquidity solutions that optimise real-time usage and improve cash flow forecasting. dbXadvise complements this by offering data insights, advisory services and flexible API reporting, empowering treasurers with self-service tools to manage complex market conditions more effectively.

Similarly, United Overseas Bank (UOB) has enhanced its cash management platform by adopting APIs to streamline cross-border transactions and liquidity management. UOB’s API technology supports cross-regional multi-currency cash management, especially for the businesses engaged in e-commerce and new age economy sectors and providing them with smooth cross-border instant payments and processing. The platform also automates payment initiation and reporting, allowing businesses to streamline their treasury operations. As treasurers seek to automate information flows and connectivity, APIs allow seamless integration with corporate systems, FIs and payment platforms.

Bangladesh’s City Bank has addressed the challenges of a paper-heavy ecosystem by enabling real-time data exchange between client systems and its own infrastructure. Businesses benefit from continuous access to financial data, helping them track cash flows, manage balances and process payments across different currencies and regions.

In India, Kotak Mahindra Bank has also launched a dedicated API portal to simplify integration for handling bulk payments, collections and reconciliation. This has significantly enhanced corporate connectivity by providing real-time updates on transactions and account balances, reducing operational inefficiencies.

API integration is also central to Bank of America’s payment strategy. Through its CashPro platform, treasurers can automate payment workflows, enhance reporting accuracy and gain real-time control over funds across geographies. This empowers faster, data-driven decision-making and more efficient cash flow management.

As corporate treasurers face mounting challenges, APIs are reshaping treasury operations. By enabling real-time integration between treasury management systems (TMS), ERP platforms and other applications, APIs enhance visibility and replace traditional batch-based reconciliations with up-to-date, accurate data. This gives treasurers immediate insight into financial positions, supporting faster, more informed decisions and driving greater efficiency and effectiveness.

Multi-currency flows drive demand for effective cross-border cash management

The need for real-time or “just-in-time” treasury solutions — where information is accessed exactly when needed — is especially pronounced in cross-border cash management. The growing prevalence of multi-currency flows, particularly within Asia Pacific, is intensifying demand for more effective treasury solutions. According to the TABInsights Asia Pacific Cash Management 2025 Survey, 78% of respondents noted an increase in cross-border, multi-currency flows among their customers’ operations, reinforcing the need for real-time data to manage complex financial interactions.

As businesses expand globally, banks are embedding more digital capabilities, especially API integration, to deliver real-time liquidity management and faster settlement times. These enhancements enable businesses to manage cross-border and multi-currency flows more efficiently, improving cash visibility and enabling more informed decision-making.

Customised solutions for diverse treasury needs

Treasury challenges vary widely by company size, industry and geography, compounded by the regulatory complexities of cross-border payments and liquidity management. In response, banks are increasingly offering tailored solutions to meet the diverse needs of businesses, particularly those operating internationally. Reflecting this trend, 56% of TABInsights Asia Pacific Cash Management 2025 Survey respondents reported an increased focus on customisation in cash and liquidity management offerings.

For example, UOB leveraged its client advisory and advocacy strength, digital capabilities and regional presence to implement a customised cash and liquidity structure for a corporate client. This solution incorporated Singapore dollar and US dollar cash sweep structures and sustainable accounts into a notional pooling framework. The setup automated the consolidation of surplus funds across 145 accounts spanning over 130 entities, significantly enhancing liquidity visibility and control.

Likewise, Bank of China (Hong Kong) tailored its multi-currency liquidity offering for companies operating across jurisdictions. The solution enabled centralised cash pooling in a designated currency, while retaining flexibility in currency usage. This improved group liquidity control, FX risk management and working capital deployment.

Such customised solutions help treasurers optimise working capital, improve cash flow forecasting and manage liquidity across a broad range of accounts and entities. This flexibility not only strengthens financial agility but also supports sustainable growth by aligning treasury operations with evolving business needs.

Virtual accounts for high-volume reconciliation

The rise of e-commerce, digital payments and platform-based businesses has created reconciliation challenges due to high transaction volumes and complexity. Virtual accounts (VA) are transforming treasury operations by streamlining cash tracking, automating reconciliation and enhancing financial control and transparency.

Corporate treasurers are increasingly adopting VA structures to gain a comprehensive view of their cash landscape and improve decision-making. To handle high-volume reconciliation, particularly in securities and logistics, Vietnam’s Techcombank developed a customised VA solution that matches incoming payments to operational activity in real time. Built on fully automated, API-integrated infrastructure, the system allows companies to dynamically assign VAs based on their internal structures.

In logistics and last-mile delivery, for instance, unique VA identifiers can be assigned to routes, warehouses, or delivery agents. Payments received are instantly matched to the relevant entity, allowing detailed tracking and faster reconciliation. In the securities sector, each investor is assigned a distinct VA linked to a particular trading position or product. Incoming funds are automatically recognised and credited to the corresponding brokerage account, with the entire process powered via API integration.

As businesses navigate increasingly complex cross-border liquidity challenges — particularly in markets with tighter regulations — the demand for customised, API-driven solutions is expected to grow significantly.

Future-proofing treasury management with automation and AI

The rise of AI, automation and machine learning (ML) is transforming treasury management functions, driving greater precision and efficiency in cash and liquidity management. Banks are already deploying AI across various use cases, including communication and translation tools, cash flow forecasting and the automation of payables and receivables. According to the TABInsights Asia Pacific Cash Management 2025 Survey, 44% of respondents identified the growing use of AI and automation as a key driver of transformation in cash management functions.

AI-powered tools — such as ML-based cash flow forecasting — are helping treasurers navigate complex financial environments. By processing vast amounts of financial and non-financial data, AI can detect patterns often missed by human analysis, resulting in more accurate forecasts. These approaches surpass traditional statistical methods by factoring in variables such as sales trends, economic indicators, seasonal fluctuations and supply chain disruptions. Neural networks can analyse these data points in parallel to generate more precise forecasts.

Bank of America has integrated AI and ML into its cash management offerings to enable automated processing of payments and real-time cash flow visibility, particularly for cross-border clients. The solution, Intelligent Receivables, automates the matching of payments to accounts receivable. AI algorithms ensure that payments are accurately assigned to the correct invoices without manual intervention, reducing errors and processing times while enhancing visibility into cross-border cash positions.

Similarly, J.P. Morgan launched Cash Flow Intelligence, an AI-powered tool designed to help corporate clients analyse and forecast cash flows.?Using a proprietary AI algorithm, the tool has reportedly reduced manual work by up to 90% for clients, allowing them to generate customised forecasts in minutes. By automating data aggregation, categorisation and reconciliation, Cash Flow Intelligence provides treasury teams with real-time insights and actionable intelligence for more effective decision-making.

As technology continues to reshape corporate treasury functions, the adoption of APIs, AI and automation is becoming increasingly critical for staying competitive. By adopting these tools, treasurers can optimise liquidity, streamline operations and enhance risk management, ensuring treasury functions remain agile and responsive in a complex and fast-paced global market.