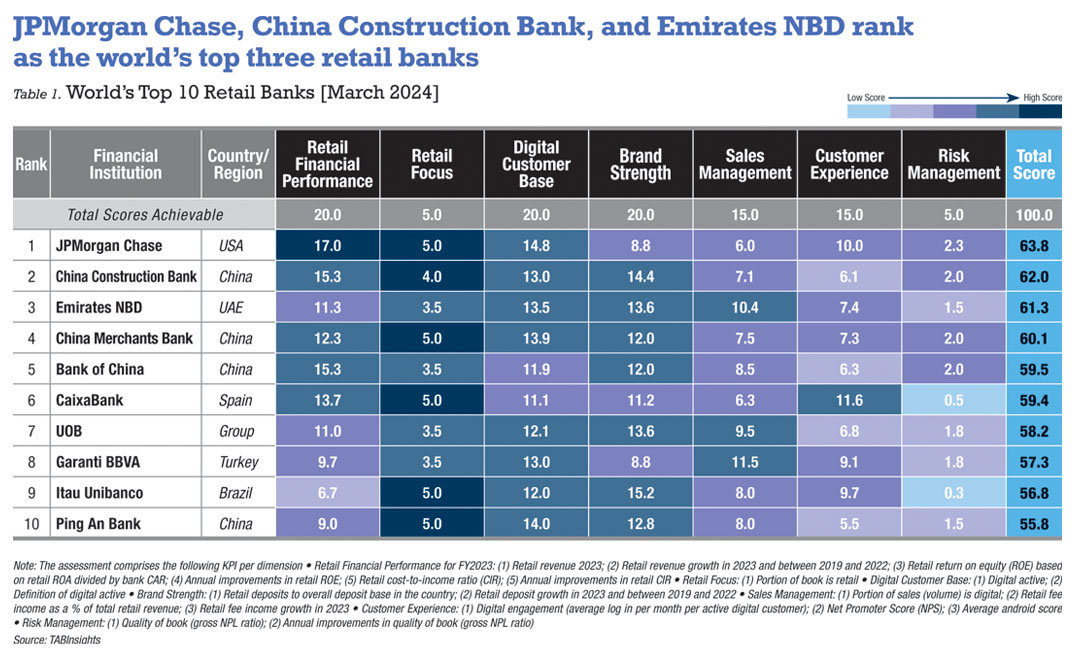

JPMorgan Chase secured the top spot as the world’s best retail bank in this year’s World’s Best Retail Banks Ranking, followed by China Construction Bank and Emirates NBD. TABInsights assessed the world’s largest and strongest retail banks in key markets globally, producing a comprehensive ranking that evaluates capabilities across seven critical dimensions: retail financial performance, retail focus, digital customer base, brand strength, sales management, customer experience, and risk management.

The assessment does not consider individual bank size as the primary strength factor and instead uses growth figures in order to standardise the evaluation process.

JPMorgan Chase scored in retail financial performance, retail focus, digital customer base

JPMorgan Chase’s Consumer and Community Banking segment stands as one of the largest retail portfolios globally outside of China. With over 141,000 staff managing average retail assets of $584 billion in 2023, the bank serves about 80 million customers and six million small businesses.

This segment has strategically fortified its presence in both online and offline channels, enhancing the franchise value within the segment and across the broader firm. The acquisition of First Republic’s assets has further expanded JPMorgan’s financial advisor network by over 200, augmenting client assets by approximately $200 billion.

Its branches play a pivotal role, with over 80% of first-time investors originating from referrals made by bankers at these locations. Simultaneously, digital sales have proven to be a significant driver, contributing an estimated 50% to 60% to overall sales origination, with 78% of its customer base digitally active. It has successfully attracted a younger demographic, with millennials and Gen Z constituting more than 45% of its customer base through its strategic digital transformation.

JPMorgan Chase has also emerged as the top retail revenue generator among the world’s top 10 retail banks. In 2023, the segment contributed a substantial $70 billion to overall revenue, constituting over 43% of the total. Demonstrating financial prowess, the retail return on assets (RoA)experienced notable growth, rising from 4% in 2022 to 5% in 2023.

China Construction Bank prioritises digital transformation, wealth management

China Construction Bank (CCB) strategically prioritises digital transformation, making substantial investments in mobile apps, analytics, integrated data platforms, and cloud solutions. This digital approach has significantly improved customer satisfaction, retention, and activation. With financial technology investment accounting for 3% of its operating income, CCB has employed data analytics and artificial intelligence to customise products and services, successfully engaging a majority of its retail customers through personalised services. Additionally, the bank expanded into wealth management, adopting an accessible tiered customer service model. By June 2023, it managed retail assets under management totalling RMB 18 trillion ($2.5 trillion).

CCB has demonstrated robust financial performance, achieving 12% compounded annual growth rate (CAGR) for retail revenue and 15% CAGR for retail deposits from 2019 to 2022. The bank’s cost-to-income ratio (CIR) decreased from 31% in 2022 to 25% in the first half of 2023, marking the lowest among the world’s top 10 retail banks. Additionally, the bank maintained a lower retail non-performing loan ratio than its counterparts, standing at 0.6% in June 2023, despite a slight increase.

Emirates NBD leads with innovation and profitability

Renowned for its digital leadership, Emirates NBD conducts 98% of transactions digitally. The bank has heavily invested in innovation, evident through initiatives like Liv, ENBD X, and WhatsApp Banking. Its bold digital transformation, costing over $270 million, underscores its commitment to cutting-edge technology, featuring a cloud-native core banking system and a suite of digital services. Notably, ENBD X, its award-winning app, revolutionises banking, while Liv, the only profitable digital bank in the Middle East, caters specifically to a younger demographic.

Emirates NBD’s retail banking distinguishes itself with high profitability, evident in its 31% year-on-year annual growth in retail banking revenue and a robust 5.6% RoA in 2023. A key factor in this achievement is the substantial funding from the low-cost current and savings accounts, constituting 77% of total deposits. The bank’s technology investments optimised operations, resulting in an outstanding CIR of 27%, surpassing the average of 39% among the world’s top 10 retail banks. Additionally, the bank excelled in sales management, with digital sales contributing approximately 48% to overall sales and non-interest income making up 29% of total retail revenue.