- Growing liquidity pressure and deposit runs

- Losses in securities portfolios

- More banks in trouble

Silicon Valley Bank (SVB) collapsed on 10 March, the second largest bank failure in the United States (US) history. With $209 billion in total assets at the end of 2022, SVB was the 16th largest commercial bank in the US and a crucial lender in the startup ecosystem.

The collapse occurred two days after the voluntary closure of crypto-focused Silvergate Bank after its liquidity crunch. Signature Bank was shut down on 12 March, making it the third-largest bank failure in US history.

The emergency lending provided by the US Federal Reserve (Fed) to the banks amounted to approximately $300 billion within a week, compared to the $700 billion allotted in 2008 for the acquisition of failing bank assets under the Troubled Asset Relief Program.

The holding companies of SVB and Signature Bank used $143 billion while the remaining funds were borrowed by other banks to increase their cash reserves. The magnitude of the Fed’s support has raised significant concerns. The Fed raised interest rates by 25 basis points on 22 March, which could potentially exacerbate the situation.

Growing liquidity pressure and deposit runs

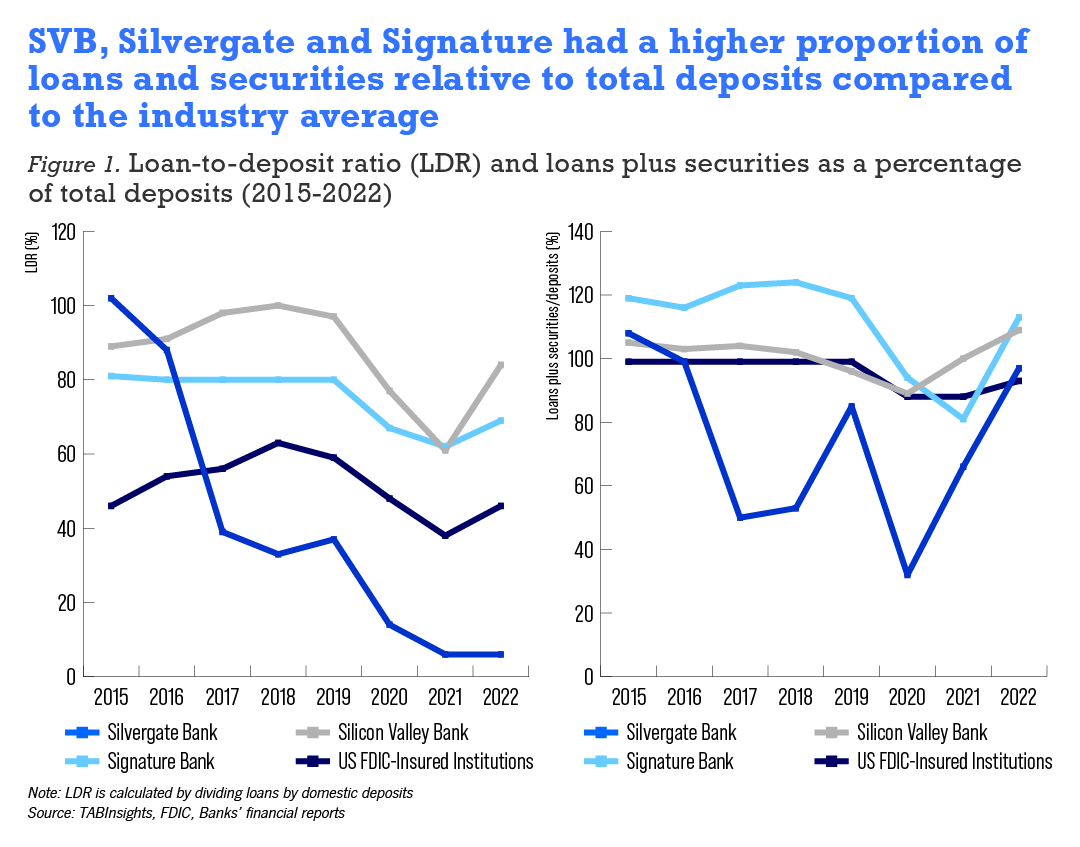

US banks have been facing higher funding costs and shrinking deposits as the Fed has aggressively raised interest rates since 2022. Total deposits in US banks fell by 2.5% in 2022 as depositors went after higher-yielding alternatives. This led to an increase in the loan-to-deposit ratio (LDR) to 69% from 62% in the previous year. The trend of deposit outflows has continued into 2023, further compounding liquidity challenges.

Banks that have less diversified deposit bases or a large percentage of uninsured deposits are vulnerable to risk. SVB, for example, provided services to almost half of all US venture-backed technology and healthcare startups. Its deposits were mainly concentrated in the tech and startup sectors, with 94% of its domestic deposits being uninsured.

Silvergate Bank largely relied on funding from crypto investors and exchanges, while Signature Bank also had a high percentage of uninsured deposits at 90% in 2022.

Total deposits of SVB surged by 64% in 2020 and 86% in 2021 as startups received substantial funds that were deposited into the bank. However, its deposits declined by 8% in 2022. Its client cash burn has continued at a rapid pace despite funding for startups drying up.

SVB sold $21 billion of its available-for-sale (AFS) securities at a loss of $1.8 billion and also disclosed plans to raise $2.25 billion as the pace of withdrawal escalated. This caused alarm among venture capital firms and startups and sparked the bank run, with depositors attempting to withdraw $42 billion in deposits, equivalent to approximately 25% of the bank’s total deposits, in a single day.

Silvergate Bank witnessed a significant withdrawal of deposits from its clients amounting to $8.1 billion following the collapse of the crypto exchange FTX. Its total deposits fell to $6.3 billion at the end of 2022.

On 12 March, customers of Signature Bank withdrew over $10 billion in deposits due to concerns surrounding banks that hold substantial levels of uninsured deposits.

Losses in securities portfolios

Aggressive interest rate hikes have lowered the value of US Treasuries and other securities that many banks had purchased during the era of ultra-low interest rates. As a result, US banks had $280 billion in unrealised losses on AFS securities and $341 billion in unrealised losses on the held-to-maturity (HTM) securities by the end of 2022.

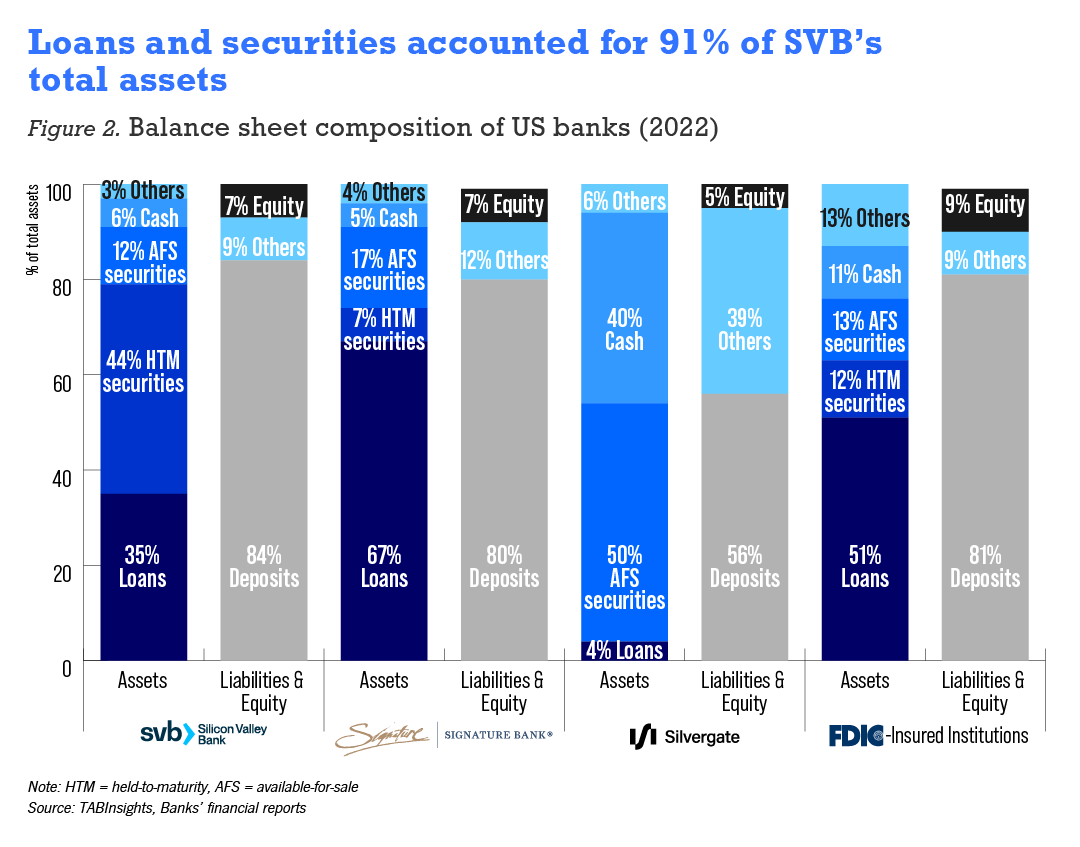

SVB and Silvergate had a higher proportion of loans and securities relative to their total deposits, although their LDR was lower than the average US bank’s. They invested heavily in mortgage-backed securities (MBS) and other US government bonds as lending activity was weak.

The percentage of SVB’s total assets allocated to investment securities rose from 40% in 2019 to 60% in 2021. The bank held some securities with shorter duration as AFS and longer duration securities as HTM. At the end of 2022, 78% of SVB’s investment securities were classified as HTM, compared to 35% in 2020, and the average duration of its HTM securities portfolio extended to 6.2 years.

However, there was insufficient hedging to mitigate interest-rate risk. In 2022, SVB recorded an unrealised loss of $15 billion and was technically insolvent, although this did not impact its regulatory capital.

Silvergate, in addition to obtaining $4.3 billion in short-term borrowings from the Federal Home Loan Bank of San Francisco, sold $5.2 billion of debt securities during the fourth quarter of 2022, resulting in a loss of $0.7 billion. By the end of 2022, Silvergate's equity-to-asset ratio had fallen to 5%, significantly lower than the average of 9.3% for US banks. Its securities that were formerly classified as HTM were reclassified as AFS in 2022.

More banks in trouble

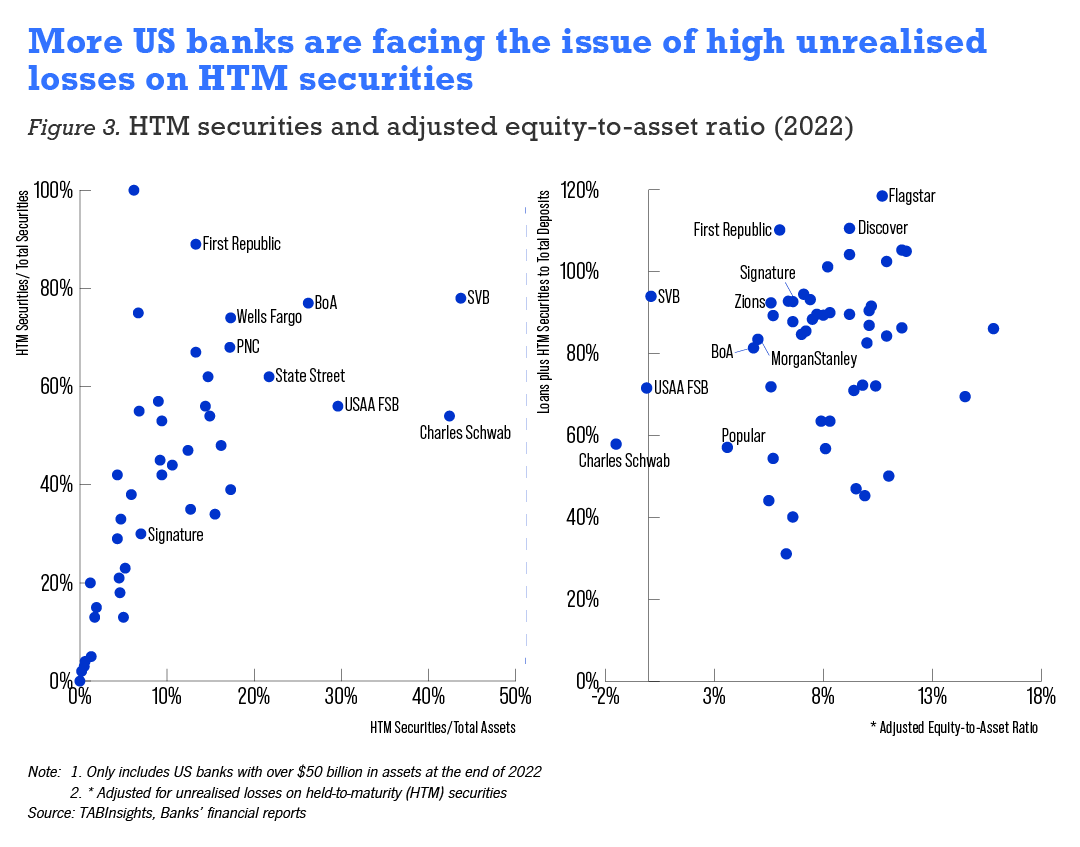

Several other US banks are also facing increased pressure due to their significant proportion of HTM securities. Among them is First Republic Bank that is currently facing significant challenges; its customers withdrew approximately $70 billion in deposits, equivalent to 40% of the $176 billion it held at the beginning of the year. The bank received $30 billion in deposits from 11 major US banks to bolster its liquidity. Despite this, there are still concerns that the bank may need to raise additional funds or even consider selling itself.

First Republic Bank had a relatively low proportion of HTM securities to total assets, amounting to 13.3% at the end of 2022. However, these securities made up a significant 89% of the bank’s total securities. It also had the third-highest ratio of loans plus HTM securities to total deposits among US banks with over $50 billion in assets. Furthermore, 68% of its total deposits were uninsured.

Both Charles Schwab Bank and USAA Federal Savings Bank had a high ratio of HTM securities to total assets at the end of 2022, at 42% and 30%, respectively. Their equity-to-asset ratios were among the lowest in the US, at 2.2% and 2.7%, respectively. If these banks need to sell HTM securities, the losses could easily wipe out all of their equity.

Charles Schwab Bank, the banking subsidiary of Charles Schwab Corporation, had total assets of $349 billion at the end of 2022. In 2022, $148 billion of its AFS securities were reclassified as HTM. However, Charles Schwab has stated that it has sufficient liquidity and does not need to sell HTM securities. Its ratio of loans plus HTM securities to total deposits was relatively low at 58% in 2022. Some 82% of the bank’s deposits are insured.

With total assets of $111 billion at the end of 2022, USAA Federal Savings Bank has poor compliance risk management. In March 2022, it was fined $140 million for willfully failing to implement anti-money laundering laws. Its HTM securities increased from $4.4 billion in 2021 to $39 billion in 2022, while AFS securities declined from $62 billion to $25 billion.

Bank of America recorded the largest unrealised loss on HTM securities among US banks, amount to $109 billion at the end of 2022. Approximately 77% of its total securities were classified as HTM securities, accounting for 27% of its total assets. Despite this significant loss, Bank of America has a more diversified deposit base. It is among the mega banks that have reported receiving inflows of funds from smaller banks.

Regulation

The failure of these banks can be partially attributed to inadequate regulation. Smaller banks in the US do not have to comply with the liquidity coverage ratio and net stable funding ratio requirements. The Fed also reduced reserve requirement ratios on all net transaction accounts to 0% in March 2020, eliminating reserve requirements for all depository institutions.

There is no official government bailout, but the US Treasury, the Fed, and Federal Deposit Insurance Corporation declared that all depositors of SVB and Signature will have access to the full amount of their deposits.

Meanwhile, the Fed created a new Bank Term Funding Program to offer loans of up to one year to eligible US depository institutions and US branches, or agencies of foreign banks that pledge qualifying assets as collateral. This provides liquidity to institutions that hold assets with long maturities to meet the demand for withdrawals.

On 22 March, the Fed raised the interest rate by 25 basis points as part of its aggressive campaign to tame inflation. Although Treasury Secretary Janet Yellen stated that large withdrawals from regional banks have stabilised, it is crucial for the Fed and other regulatory bodies to monitor the situation closely.

Due to the modern fractional reserve banking system, no bank will ever hold enough liquid assets to survive a sustained bank run. Hence, central banks play the key role of lender of last resort to ensure and restore not so much stability, but trust that undergirds the edifice on which it is built.

.webp)