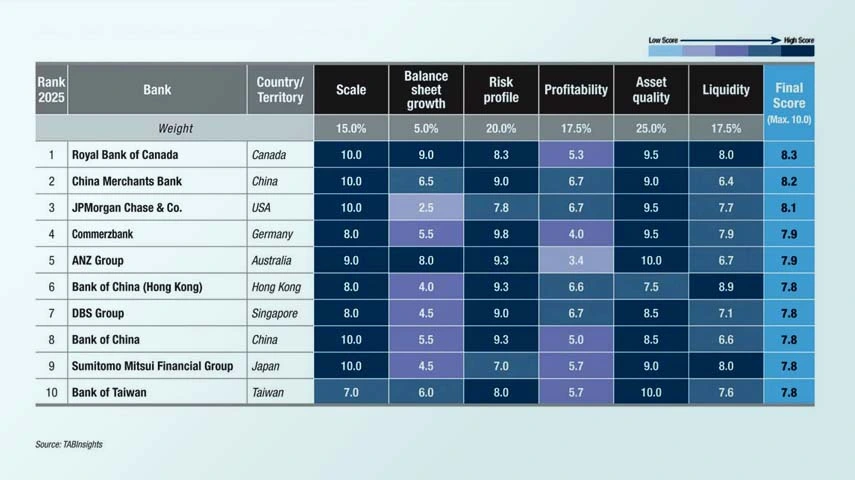

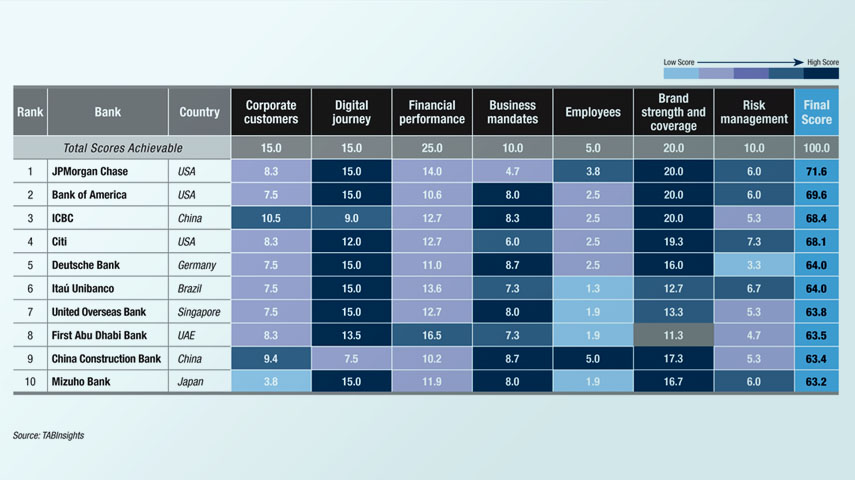

JPMorgan Chase and Bank of America lead large-bank revenue per employee rankings, while mid-tier banks such as First Abu Dhabi Bank and Saudi Awwal Bank report higher overall productivity levels, supported by focused business models, digital adoption and cost discipline.