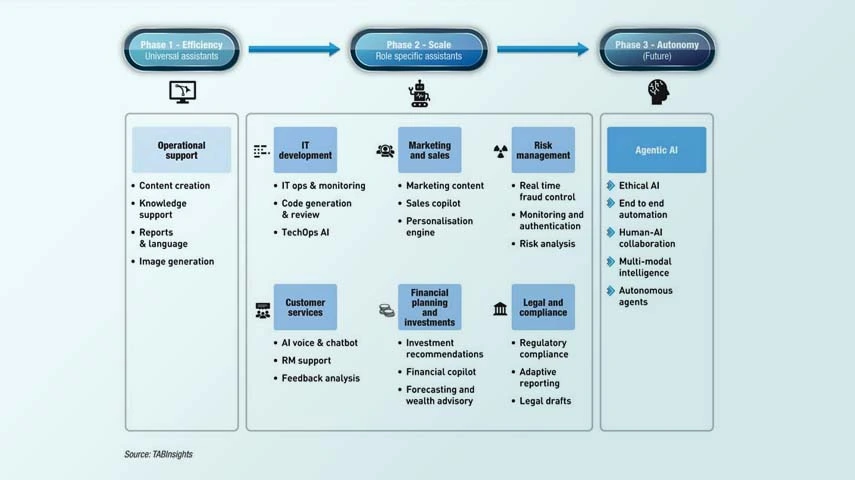

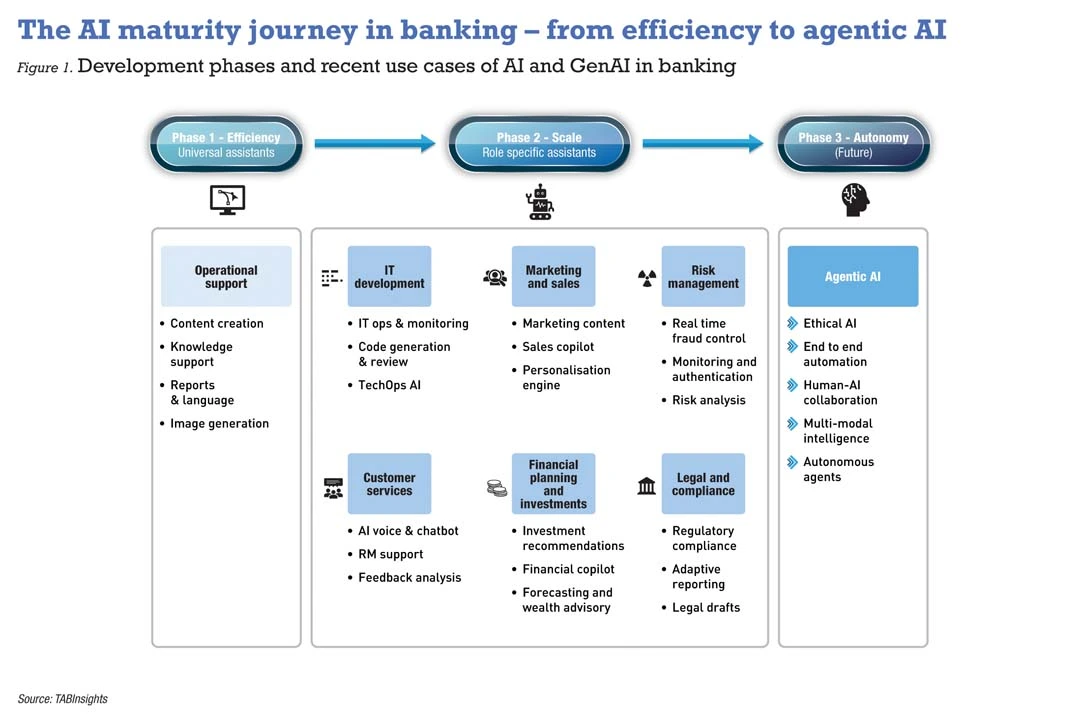

Artificial intelligence (AI) adoption in banks has quickly moved from pilots in automation and analytics to enterprise scale, with generative AI (GenAI) and large language models (LLM) driving momentum. Banks are shifting from isolated experiments to AI-driven capabilities that are reshaping operations and transforming customer service. AI creates new opportunities but also heightens risks, making governance and oversight essential. The future will be defined by how effectively banks embed intelligence responsibly—at speed, at scale and with trust. If the first wave was about feasibility, the second is about scale and the third will be defined by autonomy.

From experiments to enterprise scale

The first wave of adoption centred on feasibility and efficiency using machine learning, robotic process automation and predictive models. GenAI has since democratised access, allowing both technical and business teams to build solutions faster. Leading banks are moving from generic tools to role-specific applications deployed at speed. The next shift is towards agentic AI—systems that can act autonomously, adapt in real time and collaborate with humans. Multimodal intelligence that blends text, voice, image and behavioural data links back-office processes with customer experiences.

Use cases boost efficiency, enhance risk management and personalise experiences

TABInsights data shows that top institutions in APAC are running hundreds of models across domains. Banks are embedding AI to transform productivity, improve customer engagement and strengthen predictive risk management. They are combining GenAI with traditional models for intelligent automation, fraud monitoring and real-time threat detection, while accelerating software development and customer nudges.

“We started with RPA (robotic process automation) a few years ago, and now we’re moving into agentic AI,” said Cyrene Kong, chief digital officer, RHB Bank, highlighting the shift. “AI allows us to understand customer needs better and provide more personalised service. We’re integrating GenAI into our chat functions, enabling more intuitive customer interactions,” she explained.

In the Philippines, Lito Villanueva, executive vice president and chief innovation and inclusion officer, RCBC explained that they now use AI-driven wealth management, automated investment recommendations and faster loan processing.

Domain-specific LLMs are becoming key differentiators. Kasikorn Bank has deployed AI across multiple use cases including a financial LLM that outperforms open-source benchmarks, accompanied by a multi-agent platform for real-time automation. Techcombank developed LLM models for Vietnamese-English translations.

Banks are scaling up their use of AI. OCBC has deployed more than 300 AI use cases and 30 GenAI applications ranging across knowledge assistants, stock picking, financial planning and AI-based surveillance, among others. Its Gen AI applications automate role-specific operational workflows, while its recommendation engine has driven higher customer engagement with personalised offers and increased click-through rates.

As use cases expand, scale and governance will determine success.

Scaling AI requires disciplined model management and trusted data

To move beyond experimentation, leading banks are strengthening governance, engineering practices and staff training.

Tiravat Assavapoke, executive vice president of data intelligence and IT integration division at Kasikorn Bank, said the bank has adopted a two-pronged approach to democratising AI. From the top-down, business units define strategic goals and identify AI opportunities. From the bottom-up, the bank trains 20,000 employees on AI use cases and tools. This dual-track approach is backed by governance that aligns innovation with regulation and enforces data privacy.

Banks are also tapping open-source models and closer product-tech integration to accelerate value creation. By embedding AI into continuous integration pipelines and adopting machine learning operations (MLOps) and reusable capabilities, they are speeding up time to market.

Data remains the foundation. Poor quality or fragmented data undermines AI outcomes, making integration critical.

“In December 2024, we launched our first AI personalisation engine This combines AI, big data and cloud technologies to deliver real-time recommendations and meaningful customer interactions”, said William Streitberg, chief technology officer, Hong Leong Bank. The bank powers this through a data lake and real-time recommendations. “One of our key achievements in 2024 was the launch of Marina, a chatbot powered by Nvidia GPUs. It is likely one of the first in the region to run its own models in-house,” he shared.

Security Bank has deployed a streaming-first, real-time data mesh to speed up product launches and responsiveness. OCBC has rebuilt its legacy data warehouse into a real-time, analytics-ready infrastructure using a hybrid open-source stack and data mesh principles.

Managing risks while scaling

Scaling AI introduces risks ranging from hallucinations, bias and black-box opacity to model drift. Models need to be adequately trained and tested. Ethical issues and regulatory uncertainty across jurisdictions add complexity, while malicious AI-led attacks and cyber risks heighten exposure. System resiliency and third-party dependencies must also be evaluated.

“Increasingly ethical considerations and data privacy have become our top priorities, ensuring AI is deployed safely and effectively,” said Villanueva.

Banks are responding with guardrails. Model management platforms centralise development and monitoring, while automated systems track data quality, performance and drift. Centres of Excellence bridge IT, compliance, security and business, and ensure regulatory adherence.

China Construction Bank has implemented an enterprise-wide, end-to-end model risk management platform that integrates AI technologies to govern the full lifecycle of thousands of models. This has shortened deployment timelines by two months and reduced model-related risk events by 30%.

Regulators are also stepping up oversight. Effective January 2026, South Korea’s AI Basic Act will mandate transparency, safety and risk-assessment for high-impact and generative AI. Singapore has updated its Model AI Governance Framework for GenAI with nine risk-based dimensions, while China’s Interim Measures regulate public-facing GenAI.

Despite the momentum, caution prevails. Many banks are piloting GenAI internally but remain cautious of customer-facing deployment. Human oversight is non-negotiable, with AI treated as a co-pilot rather than a pilot. Continuous training and process alignment has become essential as adoption deepens.

The next horizon – agentic AI

AI will no longer sit at the margins of banking but at its centre, driving hyper-personalisation and real-time decision-making. The next phase of intelligence will be shaped not only by predictive models, but also by autonomous agents that can negotiate, transact and collaborate across ecosystems.

Agentic AI has the potential to shift banking from reactive analytics to proactive orchestration. Instead of waiting for human prompts, agents could initiate credit assessments, optimise liquidity positions or rebalance portfolios. A single agent may continuously scan transaction data and market feeds to detect emerging risks, update customer or counterparty risk profiles, and trigger timely interventions. Others could autonomously investigate suspicious activity by linking data across multiple systems, and then escalate or act on urgent compliance issues in real time. Potential use cases are numerous. As these capabilities mature, agentic AI will evolve into a critical layer of future banking workflows.

The banks that succeed will treat AI not as a collection of tools but as an institution-wide operating model—governed, transparent and embedded into daily processes. Those that delay risk ceding ground to peers that scale responsibly and at pace, setting the competitive tempo for the industry.