- Aggregate total assets of the four Saudi Arabian Islamic banks on the list exceeded that of the 17 Malaysian Islamic banks

- Saudi Arabian and Turkish Islamic banks obtained impressive results

- Bank Mega Syariah, Maybank Islamic and Meezan Bank are the top three strongest Islamic banks in Asia

With total assets up by 33% to $166 billion in 2021, Saudi Arabia-based Al Rajhi Bank remained the largest Islamic bank in the world, according to the evaluation of the 100 largest Islamic banks and financial holding companies (banks) in the world for the financial year (FY) 2021, with March 2022 cutoff. This year’s evaluation covers banks from 26 countries and ranks them according to asset size and overall strength. Only Islamic banks which financial data was available in FY2021 were included in the rankings.

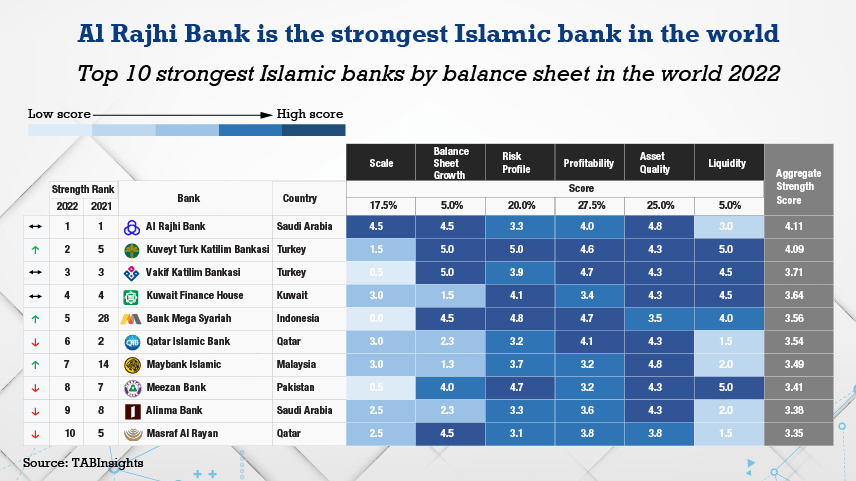

Al Rajhi Bank retained the top spot in the ranking of the strongest Islamic banks in the world, based on a detailed and transparent scorecard that evaluates Islamic banks on six areas of balance sheet financial performance, namely the ability to scale, balance sheet growth, risk profile, profitability, asset quality, and liquidity. The bank excelled in all areas excluding liquidity. It registered higher profitability, with its return on assets (ROA) up from 2.5% in 2020 to 2.7% in 2021 and its cost to income ratio (CIR) down from 32.5% to 26.9%. Its asset quality remained strong, evidenced by the low gross non-performing loan (NPL) ratio of 0.65% and the high loan loss reserves to gross non-performing loans (NPLs) ratio of 306%. However, the bank saw its liquidity position weaken, with its liquid assets to total deposits and borrowings ratio declining to 19.2%.

Saudi Arabia held the largest share of total assets

The 100 largest Islamic banks combined had $1.5 trillion in total assets, $931 billion in net financing, $1.1 trillion in customer deposits and $21.1 billion in net profit. Malaysia had the most Islamic banks on the list, with 17 banks holding $248 billion in assets. Saudi Arabia held the largest share of total assets, at 18.4%, followed by Malaysia (17%), Iran (16.2%), the UAE (10.6) and Qatar (10.1%). The aggregate total assets of Saudi Arabian Islamic banks exceeded that of Malaysian Islamic banks, as the four Saudi Arabian banks in the ranking grew total assets by 24.2% in 2021, against 5.6% for the Malaysian Islamic banks.

The top 10 largest Islamic banks include two Saudi Arabian banks, two Iranian banks, two UAE banks, two Qatari banks and one each from Kuwait and Malaysia. This year, the data gathered for three Iranian banks were not included in the previous year’s ranking. Iran-based Tejarat Bank and Bank Pasargad placed second and third in the ranking of the largest Islamic banks. Total assets of these two banks surged by 39.8% and 46.6%, respectively.

Dubai Islamic Bank, Kuwait Finance House, Maybank Islamic and Qatar Islamic Bank fell to fourth, fifth, sixth and seventh, respectively, while Qatar-based Masraf Al Rayan retained its eighth position. Total assets of Masraf Al Rayan expanded by 43.7%, due to the merger with Al Khalij Commercial Bank.

Saudi Arabian and Turkish Islamic banks demonstrated the highest strength

Saudi Arabian and Turkish Islamic banks attained the highest average strength scores, at 3.79 and 3.55 out of five, respectively. Islamic banks in both countries registered strong balance sheet growth and remained well capitalised. The average capital adequacy ratio (CAR) of Saudi Arabian Islamic banks declined marginally from 19.5% in 2020 to 19.3% in 2021, while Turkish Islamic banks saw the average CAR rise from 18% to 19.3%. Saudi Arabian Islamic banks demonstrated good asset quality and profitability, with the average gross NPL ratio easing to 1% from 1.3% and the average ROA improving from 1.9% to 2.2%. Turkish Islamic banks recorded stronger liquidity, as reflected by the higher average liquid assets to total deposits and borrowings ratio of 46.1% compared with 17.5% for Saudi Arabian Islamic banks.

The top 10 strongest Islamic Banks comprised two Saudi Arabian banks, two Qatari banks, two Turkish banks and one each from Indonesia, Kuwait, Malaysia and Pakistan. Turkey-based Kuveyt Turk Katilim Bankasi and Vakif Katilim Bankasi took second and third spots, driven by good performance in most indicators.

Asian Islamic banks performed well in asset quality and capitalisation

Forty-four out of the 100 largest Islamic banks are from Asia. These banks held 24.5% of the aggregate total assets of the 100 banks. The top 10 largest Islamic banks in Asia consisted of eight Malaysian banks and one each from Bangladesh and Indonesia, while the top 10 strongest comprised five Indonesian banks, four Malaysian banks and one Pakistani bank.

The strength score of the Asian Islamic banks averaged 2.8 out of five, lower than the average for all the 100 Islamic banks, at 2.99. Overall, these banks delivered better performance in asset quality and capitalisation. Their average gross NPL ratio stood at 2.16%, slightly lower than the global average, at 2.25%. Bank Mega Syariah, Maybank Islamic and Meezan Bank are the top three strongest Islamic banks in Asia. All these three maintained strong capital positions and reported asset quality improvement.

Islamic banking has been adopted by more countries and banks. In July 2022, Australia licensed its first-ever Islamic bank, Islamic Bank Australia. Going forward, the Islamic banking industry will sustain the growth momentum.

Click here to see the Largest Islamic Banks 2022

Click here to see the Strongest Isloamic Banks 2022