- Scaling up as UPI value of transactions reach $144 billion

- Transforming towards leaner core, modernising data architecture

- Bottlenecks in cloud adoption

- Focus on data consolidation and advanced analytics

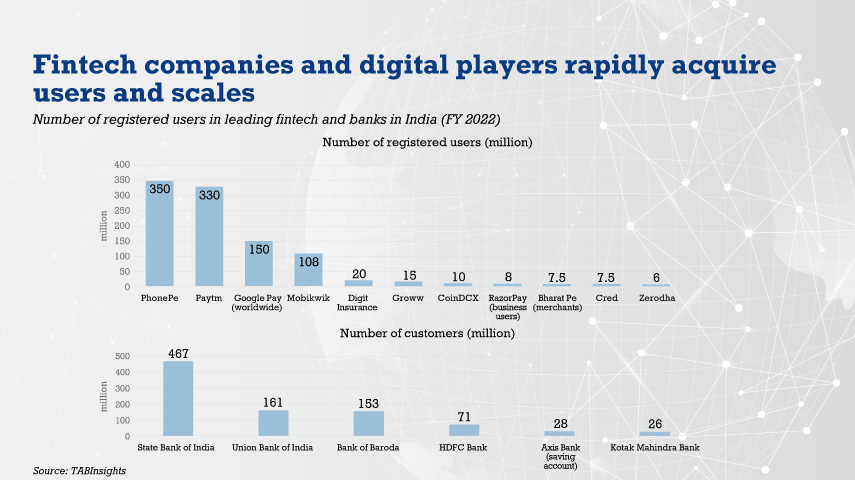

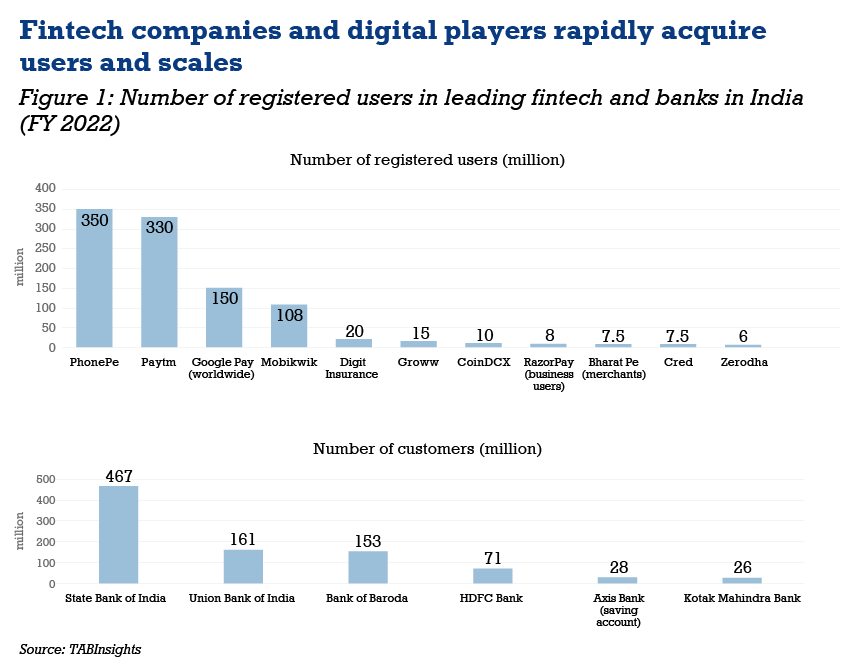

Across the world, fintech platforms and digital-only banks are encroaching into traditional bank market share, and rapidly gaining users using innovative technology. Most of these scale on the foundation of cloud technology and open ecosystems to exploit network opportunities and deliver data monetisation.

India’s financial sector has accelerated its digital transformation and sees a growing concentration of new players in the retail payment market. Fintech companies penetrated the white spaces in the financial services industry with alacrity, resulting in a steep increase in user base.

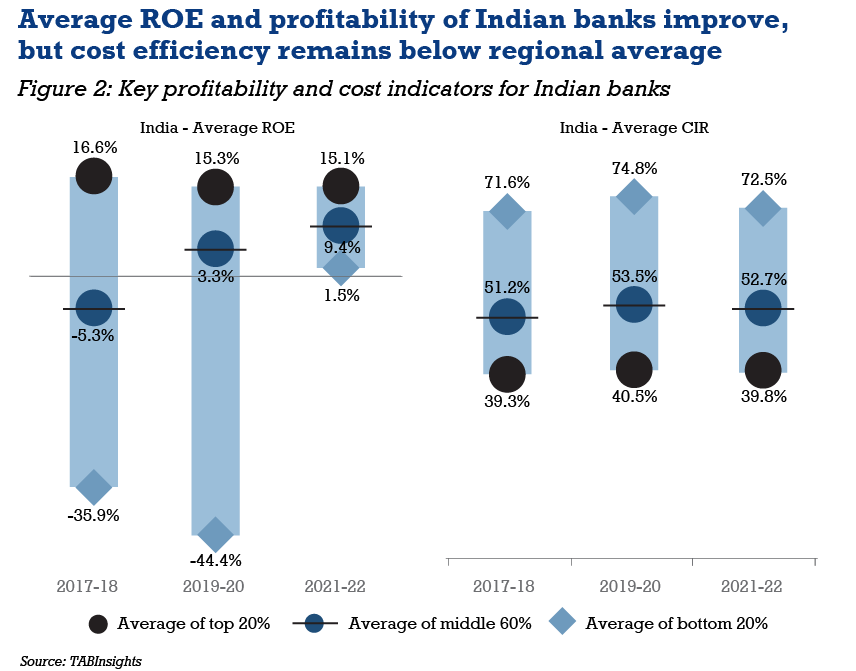

Innovating with speed to meet fast-changing customer demands and compete with new market players requires a rethink in traditional banking institutions. As banks target new revenue streams and address the growing challenges of customer growth, profitability and cost-efficiency, the industry is being inexorably propelled towards wider digital enablement, and expanding customer reach through partnerships and advanced data insights to move ahead.

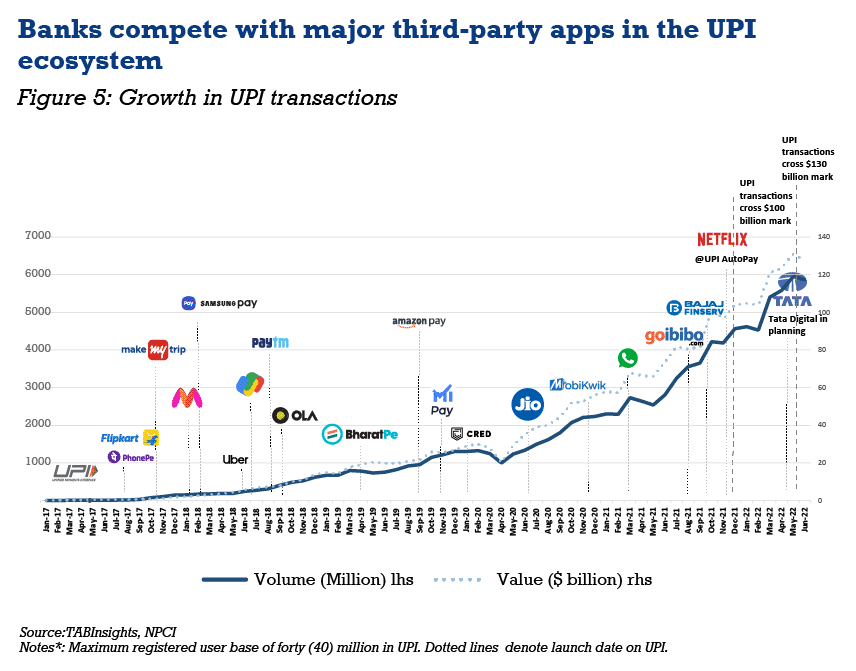

Bank systems need to scale to meet surge in digital transactions as UPI value hits $144 billion

There is urgency now for more scalable and operationally efficient technology. Legacy infrastructure and monolithic architecture in Indian banks struggle to meet the exponential rise in volumes of digital and real-time transactions.

ICICI Bank said that one of its challenges is reusable and scalable architecture. Legacy systems limit the ability to compete. Around 70% of non-financial traffic results in performance bottlenecks that need to be decongested. The bank is looking to simplify its application landscape that currently has 768+ apps with overlapping functionalities.

Banks are also focusing on holistic customer journeys and experiences. Avinash Raghavendra, president and chief information officer of Axis Bank said: “As a bank, we have six imperatives from a technology standpoint that we are chasing. We are enhancing and accelerating customer deliveries, end-to-end customer journeys, modernising the core and fixing the basic - the entire talent and governance stack - with a lot of focus on risk and security.”

Technology change needs to be accompanied with a shift in organisational culture, structure and architecture design.

Union Bank of India (UBI) claims to be 78% digital. It started its ‘next phase’ of digital initiatives in 2022. Anil Kuril, chief technology officer at UBI said: “Digital adoption is not only technology adoption, but more of a cultural shift, organisational and technology realignments.”

UBI has a five-year plan to capture 50% of liability (savings and current deposits) and assets in the retail, agriculture and micro (RAM) category, and small and medium-sized enterprises (MSME). The bank intends to acquire its portfolio through digital channels by 2025.

ICICI Bank is also carrying out an end-to-end assessment of its current architecture and formulating an end-state design. Its vision is based on three propositions: relaunch experiences through business programmes for market impact; re-architect the bank and decongest it with scalable event-driven architecture; and reorganise to deliver change, organise around platforms and adopt new ways of working.

The bank will focus on a new data platform on the cloud, shift away from product-centric operations and reimagine the customer. It has created microservice-driven decoupled architecture to simplify the app landscape and decommission moot apps. The architecture is reusable and scalable, using a DevXOps platform and shared micro-services.

The surge in the volume of digital payments and real-time transactions during the COVID-19 pandemic signalled the urgency for developing and adopting new technology. The volume and value of monthly unified payment interface (UPI) transactions nearly doubled from January to December 2021, surpassing $100 billion in December and reaching a record $144 billion in November 2022.

The number of banks on UPI increased from 207 in 2020 to 376 in November 2022. The volume of UPI transactions outpaced card payments in the country by nearly eight times.

Raghavendra said that the UPI transaction growth for Axis Bank was over 100% this year. The bank’s UPI market share is hovering around 15%, which is more than its customer market share. The bank’s mobile banking transaction market share is at 14%.

As digital transactions increased, system outages across banks also increased. The Reserve Bank of India (RBI) imposed a ban on new digital launches by HDFC Bank in December 2020 after experiencing multiple outages. The ban was removed earlier this year. State Bank of India and several other banks also reported outages in 2021.

Data from online platform Downdetector showed that across most banks in India, on average, 55% of ‘reported problems’ were traced to online banking, of which 25% were login failures. The increase in outage incidents raised questions about technology systems and the resilience of banks.

Meanwhile, the ability to monetise data will be the key differentiator, but data integration, resilience and governance are sticking points. Banks need to adapt quickly to evolving regulatory changes.

Kuril noted: “The digital transformation is not only about user interface/user experience (UI/UX), but the underlying platform, data and intelligence derived from data, that need to be put in place.”

UBI created an organisational structure conducive to digital transformation. It created the Analytical Centre of Excellence to provide data-driven insights and personalisation with new banking products for a new generation customers.

Cyberfraud, ‘social engineering’ and cybersecurity risks have also increased with the use of interconnected devices requiring multi-layered initiatives.

Leading banks are tuning up with leaner cores, modernising data architecture and accelerating cloud adoption

Back-end technology and legacy modernisations have become key priorities, but individual banks vary in their strategy and progress.

Raghavendra said: “Our information technology team has grown by about 75% in the last 24 months. The focus now is on modern engineering skills, wherever there is stuff that is going to be imperative for the long-term plans of the bank. We want the internet protocol to be retained by the bank, and to be built in-house. Commensurate to that, our technology expenditure has also gone up twice over the last two years.”

Core transformation and replacement is a complex and challenging multi-year project with far-reaching implications. Several banks are currently focusing on a leaner core by moving systems out of the existing core and using modular microservice systems that increase agility and workflow.

Axis Bank’s UPI growth is significant with almost 60+ million transactions on a peak day. Raghavendra explained: “On the core side, it is a twin strategy. We continue to upgrade the core and the underlying infrastructure - wherever we believe that there are certain areas that are going to spin off into full-fledged business lines.”

The core applications for liabilities and assets are being modernised and moved into microservices. The bank is considering moving these to the cloud at a later stage. Some of the bank’s other processes have been taken out of the core system, including ‘Off-Us’ transactions, lending origination, rule engine for credit processes, and retail lending.

UBI is also hollowing its core by taking out non-essential workloads. Some of the products and business logic are being moved out of the core so it becomes lighter and can handle more transaction processing.

Raghavendra added: “This is a long-drawn journey. While the core is a very important component of technology, our legacy technology will not take us very far. The bank needs to modernise. We will discuss it with a couple of niche players and we’re about to start the proof of concept.”

Meanwhile, Bank of Baroda recently implemented a new core banking system and allied applications across its international operations in 17 countries. It has streamlined its core system along with network and infrastructure upgrades in all its overseas centres.

The magnitude of data, extensive branch setup, the scale and complexities in transitions are stumbling blocks and most banks remain cautious in undertaking a radical transformation. At the same time, transform they must.

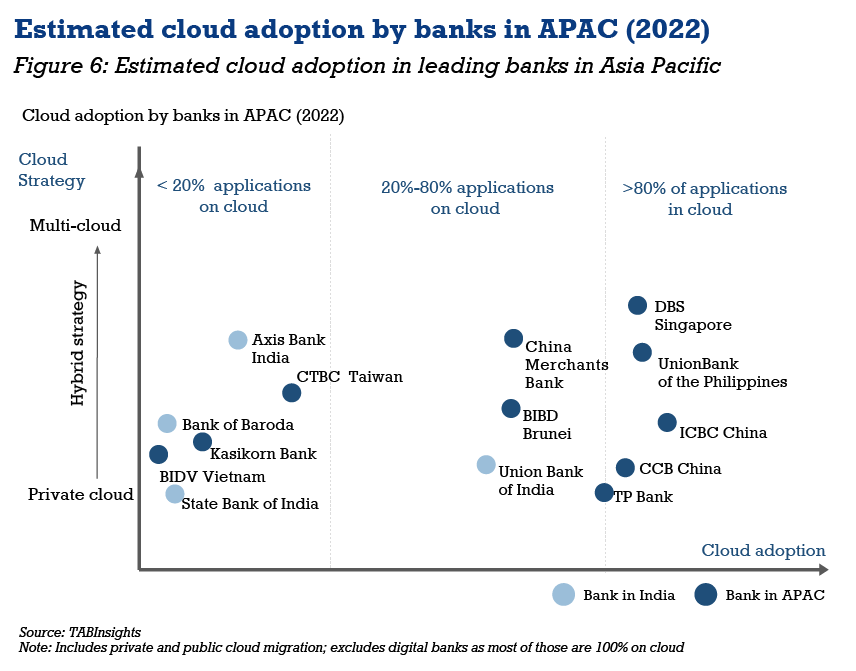

Banks seek transition to the cloud, but bottlenecks remain

Transition to the cloud enables higher flexibility in computing power, greater efficiencies, faster innovation and the ability to scale technologies such as artificial intelligence (AI). Banks need to plan and gear technology such as 5G, which is much faster and enhances connectivity, instant service and augmented computing.

Indian banks are in varying stages of cloud adoption but remain guarded. Some regional players have already migrated the majority of their applications to the cloud. Meanwhile, most digital banks are now born on the cloud.

Regulatory requirements and customer data security issues lead strategic evaluations for banks thinking about cloud migration.

Sanjay Mudaliar, chief technology officer at Bank of Baroda (BoB) said: “We are assessing the cloud readiness of our applications and infrastructure to draw a comprehensive migration strategy. We already have a few applications on the cloud.”

The strategy would give a clear roadmap and to migrate a significant portion of processes to the cloud in the short to medium term. He explained: “We are examining various cloud service provider options and setting our preferences. In the subsequent phase we will work on the development of cloud-native applications to reap the full benefit of this transition.”

Some banks prefer a private cloud strategy to address data control and security concerns. BoB is one of the largest users of private cloud infrastructure in the country with almost 70% of apps hosted on private cloud.

Kuril said: “The bank is using the VMware stack of technologies. The reason why 30% of apps could not be moved is that these apps are hosted on proprietary systems. However, new apps are coming on the private cloud only.”

Other banks have adopted a multi-cloud strategy to reduce vendor dependencies, but still, not everything is moving to the cloud.

Axis Bank was among the first banks to create three landing zones; AWS, Azure and Google cloud platform (GCP) to support a multi-cloud strategy. Raghavendra explained that their cloud strategy is straightforward. The new customer-facing journeys are essentially going to the cloud.

He said: “We will continue to stay invested in that because that is what we want - far more nimbleness than what the on-premises strategy is offering. Given our scale, we are a little cautious about how much of the expanded workload can essentially move to the cloud.”

He added: “We have around 55 of our critical apps on the cloud. When it comes to something new and innovative, the cloud is the way to go, and we are going there, even for some of the data strategies.”

When it comes to volume-driven businesses, the bank is not convinced that the cloud is the way to go. Raghavendra said: “We have an existing volume which we can support conventionally on premise at maybe a tenth of the cost we would end up incurring if we were to take it to the cloud.”

ICICI Bank is also moving towards a multi-cloud strategy and has taken a cloud-first and multi-cloud approach using MS Azure, GCP, Oracle Cloud and AWS. Its cloud journey has been planned in four waves: the setup of tech foundational platforms; mapping impacted apps basis business projects and starting the journey to cloud migration, including digital assets, associated business processes and workflow migration; working with the app simplification track and starting the journey to cloud migration; and finally, migration of the remaining apps.

Increased focus on data consolidation and advanced analytics

A truly customer-centric experience is predicated on data and timely insights. Traditional players risk falling behind big-tech and fintechs in monetising data. Consolidated data is essential for a full digital transformation to reduce costs, increase agility and provide better insights to circumvent evolving problems.

Raghavendra said: “We have an-ongoing massive data programme called data stack 3.0. This is cloud-based and real-time with a flexible architecture that covers both structured and unstructured data.”

Axis Bank invested in operational data store for data stack 1.0, and in big data lake for data stack 2.0. Data stack 3.0 takes it to the cloud and the focus is on real-time ingestion and integration. The bank is going big on personalisation. Banks want to get closer to customers with personalised nudges in real time. They are moving towards integrated data to provide highly curated products, and scale through new revenue streams whilst complying with changing regulations.

Banking platforms must cater to increasing data volume, velocity, variety and veracity. This requires data architecture that is modular, robust, cost-efficient and can drive stronger business value.

Mudaliar said: “We already have a data lake that meets our requirement of single data source. Data from 70 internal, as well as external sources are ingested into data lake and the same is used for generating reports - business as well as regulatory, management information system, dashboard, and data modelling. This provides us consistency and better control over data availability and its presentation.”

Banks are increasingly focusing towards a central and integrated repository that serves as one true source for all data. Alongside there is increased focus on intelligent automation with a combination of robotic process automation and AI for stronger predictive and targeted marketing capabilities. Several banks have expanded models based on AI and ML for risk management, operations and marketing campaigns.

UBI established the Analytics Centre of Excellence utilising AI and ML. This focuses on credit underwriting, predictive analysis of advances and arresting the stress in loan books. It developed models to predict the moving-out propensity of the bank’s savings and current account customers to take timely action.

Kuril explained: “Analytics Centre of Excellence is contributing significantly to the digital journey of various bank products. Currently, out of 16 customer journeys, some are operational and a few are in the developmental phase. These are end-to-end straight-through processing journeys without manual intervention.”

Banks have finally registered that in order to compete with new players for customers, the institutions have to keep pace with innovation and build data and technology on an ongoing basis.

Banks in India, however, should fast-track their initiatives toward strengthening their core technology, migrate towards a more flexible and modular microservice architecture and optimise the use of cloud technology. The banks need to rethink their business strategies and expand services through a network of partners through APIs. If these banks plan to be dominant players amongst the many contenders, the way forward is through automation and digitisation, a modern core, data integrations and optimising intelligent technologies.