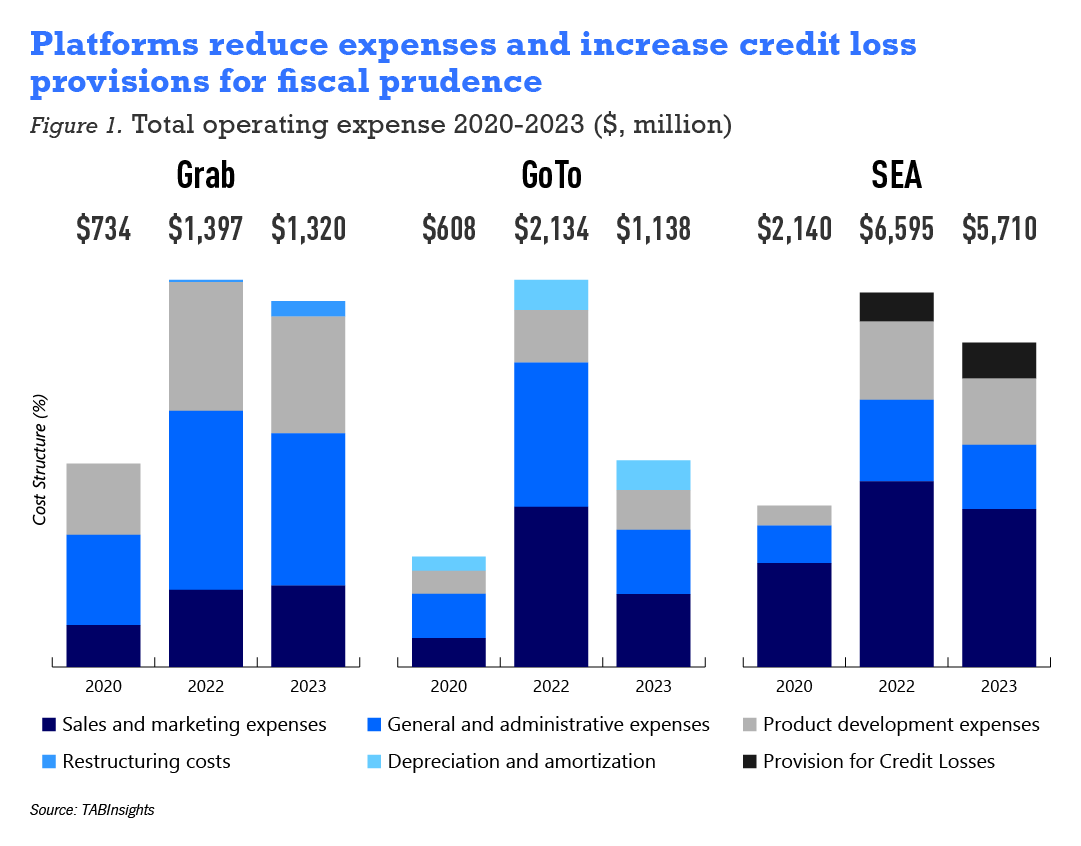

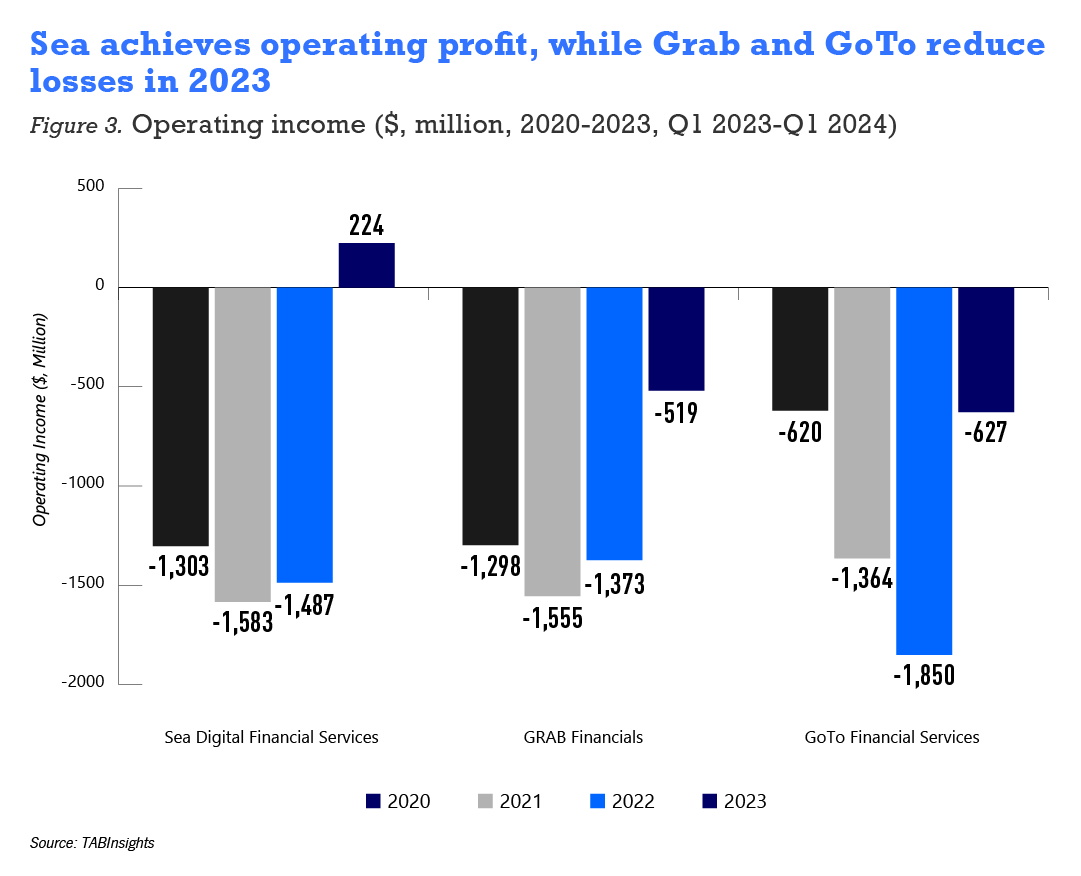

Leading platform players Grab, GoTo, and Sea Group have intensified cost management efforts since 2023, aiming for profitability by the end of 2024. While all three have reduced expenses and streamlined operations, Sea Group has notably outperformed its rivals, showing strong growth into 2024.

Fintech companies Grab and GoTo were forced to significantly reduce expenses during the pandemic years due to rising operating costs, reflecting a broader trend of fiscal prudence. In contrast, Sea Group, a consumer internet company founded in Singapore, turned its fintech segment profitable in 2023, allowing it to continue its growth trajectory with greater financial stability and strategic investments.

Grab's financial services expansion drives growth amid cost-cutting

Founded in 2012 as a ride-hailing app in Malaysia, Grab rapidly expanded into a super app offering food delivery, logistics, and digital payments across Southeast Asia. The company has diversified into financial services through Grab Financial Group (GFG), a leading Southeast Asian fintech platform providing payment and insurance products. GrabPay, a mobile wallet, and digital banking services via GXS Bank in Singapore and GX Bank in Malaysia, which were launched in 2022 and 2023, respectively, anchor this growth.

Grab’s strategic investments, such as its stake in PT SuperBank Indonesia alongside Singtel and Kakaobank, have bolstered its financial services portfolio. In 2023, Grab implemented a series of cost-cutting measures to streamline operations and enhance profitability.

Anthony Tan, CEO of Grab, said in the last fourth quarter (Q4) earnings call that “the cost reduction measures include a freeze on most hiring, salary freezes for senior managers, and cuts in travel and expense budgets.”

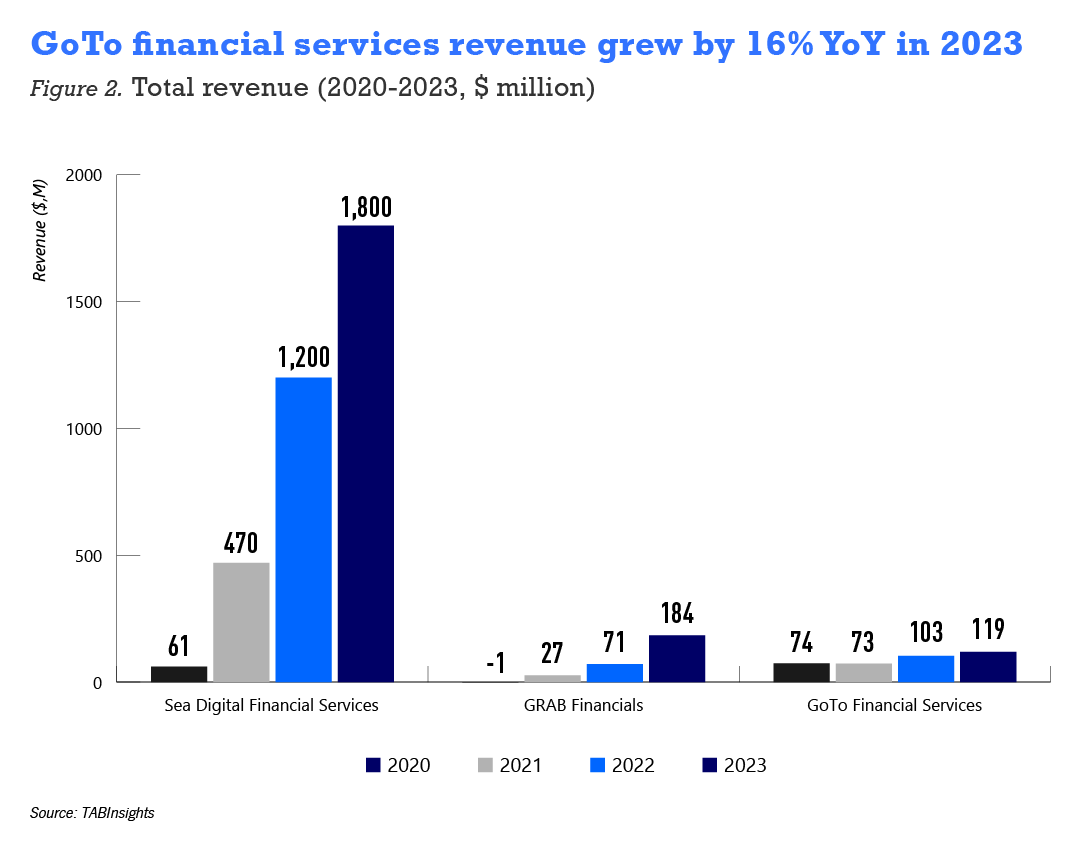

Grab’s fintech segment contributed 8% to total group revenue, with financial segment revenue increasing 159% year-on-year to $184 million. Revenue growth was driven by monetisation of payments and contributions from lending operations. This segment features GrabPay, a mobile wallet for cashless payments and other merchant services.

Additionally, Grab expanded its digital banking services with GXS Bank in Singapore and GX Bank in Malaysia. Indonesian digital banking player PT SuperBank Indonesia has secured an additional investment of IDR 1.2 trillion ($73.2 million) from its shareholders Grab, Singtel, and Kakaobank.

Grab’s financial segment revenue grew by 159% year-on-year in 2023 to $184 million, driven by monetisation of payments and contributions from lending operations. On the credit side, Grab Financial’s total loan disbursements grew 57% year-on-year in 2023, reaching $1.5 billion, with total outstanding loans amounting to $326 million.

GoTo's strategic expansion and cost-cutting drive profitability

GoTo, formed in 2021 from the merger of Indonesia’s Gojek and Tokopedia, has swiftly become a comprehensive digital platform. This merger combined ride-hailing, e-commerce, and digital payments into a unified ecosystem through GoTo Financial, enhancing user experience across its diverse services.

GoTo Financial’s offerings include GoPay, a leading mobile wallet in Indonesia, and a 22% stake in Bank Jago, a digital bank. This integration expands GoTo’s financial services and user base. In 2023, GoTo significantly reduced its operating expenses from $2.1 billion in 2022 to $1.1 billion.

The fintech segment, contributing 9% to total revenue in FY2023, includes consumer payments, lending, and merchant services. GoTo launched GoPay as a standalone app and linked it with Bank Jago’s savings account, offering unlimited balance with no transaction limits.

Revenue for GoTo Financial grew by 16% in 2023, from $103 million to $119 million. This growth was achieved through operational optimisation and cost reductions in marketing and promotional expenses.

By the end of 2023, GoTo’s consumer loan book totalled IDR 1.9 trillion ($123 million), with products including buy now, pay later (BNPL) services and loans for Tokopedia merchants and drivers.

Patrick Walujo, GoTo Group CEO, commented, “Last year, we laid a strong foundation and began a growth strategy focused on expanding our user base, increasing customer wallet share, and reducing operating costs. We expect accelerated growth for the rest of the year while staying committed to our profitability goals.”

Sea's dominance in digital platform

Sea Group, based in Singapore, began its journey in 2009 as a gaming company with the launch of Garena, its digital entertainment platform. Over time, Sea expanded into e-commerce with Shopee and later ventured into digital financial services with SeaMoney, evolving into a dominant digital platform player in Southeast Asia. This multi-faceted approach has positioned Sea Group as a key player in the region's digital economy.

SeaMoney provides a range of financial services, including mobile wallets, payments processing, and credit solutions, becoming a critical pillar of Sea Group's business.

The group's strong financial performance is largely driven by its consumer and SME credit business, which accounts for 14% of the total group revenue—nearly double the contribution compared to Grab and GoTo.

Sea also launched MariBank, a digital bank in Singapore in 2023 and has crossed SGD 200 million ($149 million) in assets under management for Mari Invest, its investment account offering.

Sea’s digital financial services revenue increased to $1.8 billion in 2023, up 50% annually, driven primarily by its consumer and SME credit business. Outstanding loan balances for Sea fintech stood at $3.1 billion at the end of 2023, the largest book among its peers.

Forrest Li, Sea chairman and CEO, stated: “We have a clear roadmap for profitable growth. Our results in the first quarter have given us a strong start to 2024, and we are well on-track to deliver our full-year guidance.”

Li highlighted Shopee’s achievements, saying: “Shopee delivered strong growth this quarter, achieving its highest ever quarterly orders, gross merchandise value, and revenue.” He emphasised Shopee’s logistics capabilities, noting that “SPX Express has become one of the fastest and most extensive logistics operators in our markets today.

On digital financial services, Li highlighted SeaMoney’s ongoing growth and profitability, adding: “We anticipate further growth while maintaining prudent risk management and expanding our financial services to better meet users' needs.”

Financial performance in Q1 2024

The first quarter of 2024 highlighted a dynamic and competitive fintech environment in Southeast Asia. Grab’s focus on operational efficiency, GoTo’s strategic integrations, and Sea’s strong financial results underscore the sector’s rapid evolution and its impact on the region’s digital economy.

Grab Financial Services reported a notable 53% year-on-year increase in revenue, reaching $55 million, in the first quarter of 2024. This growth was driven by heightened contributions from lending activities and improved monetisation of GrabFin’s payment services. Operating profit surged by 34% year-on-year to $28 million, due to higher-margin lending and a reduction in overhead expenses. Grab streamlined its operations, achieving a 15% decrease in operating expenses year-on-year and a 14% reduction quarter-over-quarter, attributed to lower staff costs and optimised cost management.

GoTo Financial Services also demonstrated significant progress, with gross revenues up 57% year-on-year to IDR 666 billion ($40 million). The increase was driven by growth in lending and consumer payments. Notably, GoTo’s integration with TikTok advanced, boosting its ‘buy now, pay later’ product on Tokopedia. Loans disbursed on Tokopedia grew nearly 60% month-on-month in March 2024, and the GoPay app exceeded 20 million downloads by the end of March. GoTo aims to address the financial services gap in Indonesia, where 97 million adults remain unbanked.

Sea Group’s Digital Financial Services division reported a 21% increase in revenue for Q1 2024, reaching $499 million. Operating profit rose 50% to $148.7 million, largely driven by consumer and SME credit, with principal outstanding loans reaching $3.3 billion, up 29% year-on-year. The non-performing loans rate remained stable at 1.4%, consistent with the fourth quarter of 2023.

The financial services sector in Southeast Asia is witnessing intense competition among these key players. All three fintechs—Grab, GoTo, and Sea—have worked to reduce general administrative expenses, including manpower costs, over the past year.

Each player has unique strengths and challenges, with Grab Financial services currently holding a slight edge due to its regional presence and diversified product offerings. Sea digital financial services has emerged as the top performer among Southeast Asian platform players.

.webp)