- More stringent regulatory supervision

- Paytm’s business model and growth

- Impact of latest regulation on Paytm’s business

India-based Paytm Payments Bank (PPB) faced strict regulatory action from the country’s central bank, the Reserve Bank of India (RBI), over its persistent non-compliance and supervisory concerns. With an estimated annual earning loss running at $60 million, how will this play out for the parent company Paytm?

On 31 January 2024, RBI barred PPB from taking further deposits, credits or top-ups in customer accounts, prepaid instruments, wallets, FASTags, and national common mobility cards after 29 February 2024 (extended until 15 March 2024). PPB is also required to terminate the nodal accounts of its parent One97 Communications and Paytm Payments Services.

Swaminathan Janakiraman, deputy governor of RBI, said the action was taken after “persistent non-compliance” and after having given PPB sufficient time to take corrective action.

RBI has flagged PPB for multiple violations over the last five years, believed to be for non-compliance, and lapses in know-your-customer requirements. The details of the violations have not been disclosed by RBI or PPB.

According to various news reports, there was inadequate verification, and numerous accounts being opened on single primary account numbers, raising concerns about potential money laundering via fraudulent accounts. PPB is reported to have over 330 million e-wallets. A significant majority of these are dormant, according to some analysts.

RBI barred PPB from onboarding new customers in 2022 and had asked for a detailed IT system audit. The latest action follows the comprehensive system audit report from external auditors, which revealed persistent non-compliances and material supervisory concerns.

The industry was surprised by the finality of the action against one of India’s pioneers in digital payments.

The parent company, Paytm and its associate payments bank, PPB, have also been subject to regulatory concern due to operational interlinkages. PPB is 49% owned by One97 Communications and 51% by Paytm’s CEO, Vijay Shekhar Sharma, in his personal capacity.

The latest disciplinary action reflects the need for compliance and governance, and ensure transparent IT systems and secure infrastructure in all entities.

More stringent regulatory supervision

Disciplinary actions across the globe highlight the growing stringent environment and intolerance to non-compliance.

In November 2023, cryptocurrency exchange Binance was fined $4.3 billion and its CEO $50 million for anti-money laundering, unlicensed money transmitting business and violating US sanctions. TikTok was fined $370 million by European Union (EU) regulators for weak user information safeguards. Meta Platforms was fined $1.3 billion by EU privacy regulators for sending user data to the US. In 2020, Wells Fargo paid $3 billion to resolve investigations into unauthorised account opening.

In 2023, RBI issued strict directives to various companies, including banning Bajaj Finance from sanctioning and disbursing loans, forbidding Bank of Baroda from onboarding new customers on its mobile app, and fined PPB and Mahindra & Mahindra Financial Services for non-compliance.

The regulator has directed SBM Bank (India) to stop all liberalised remittance scheme transactions, following material supervisory concerns. Earlier in 2020, HDFC Bank was asked to temporarily stop all digital launches and sourcing of new credit card customers following multiple outages. The latest directive on PPB is among the strictest across fintechs, with the industry already seeing knock-on effects.

PPB’s consumers and merchants are jittery about the future of their funds and payments. Macquarie’s analyst downgraded Paytm, citing serious risk of customer exodus. Competitors are eyeing market share gains from migrating customers. Meanwhile, Paytm’s (One97 Communications) investor valuation plunges, with shares dropping 45% in a week, wiping over $2 billion from its market cap.

Meanwhile, the fintech industry is advocating for balancing innovation with regulations, as over-regulation could impact future development and investments. However, the regulatory message is clear: no entity can afford to neglect strong controls and compliance. They must ensure proper audits, oversight, robust processes and architecture.

Paytm’s business model and growth

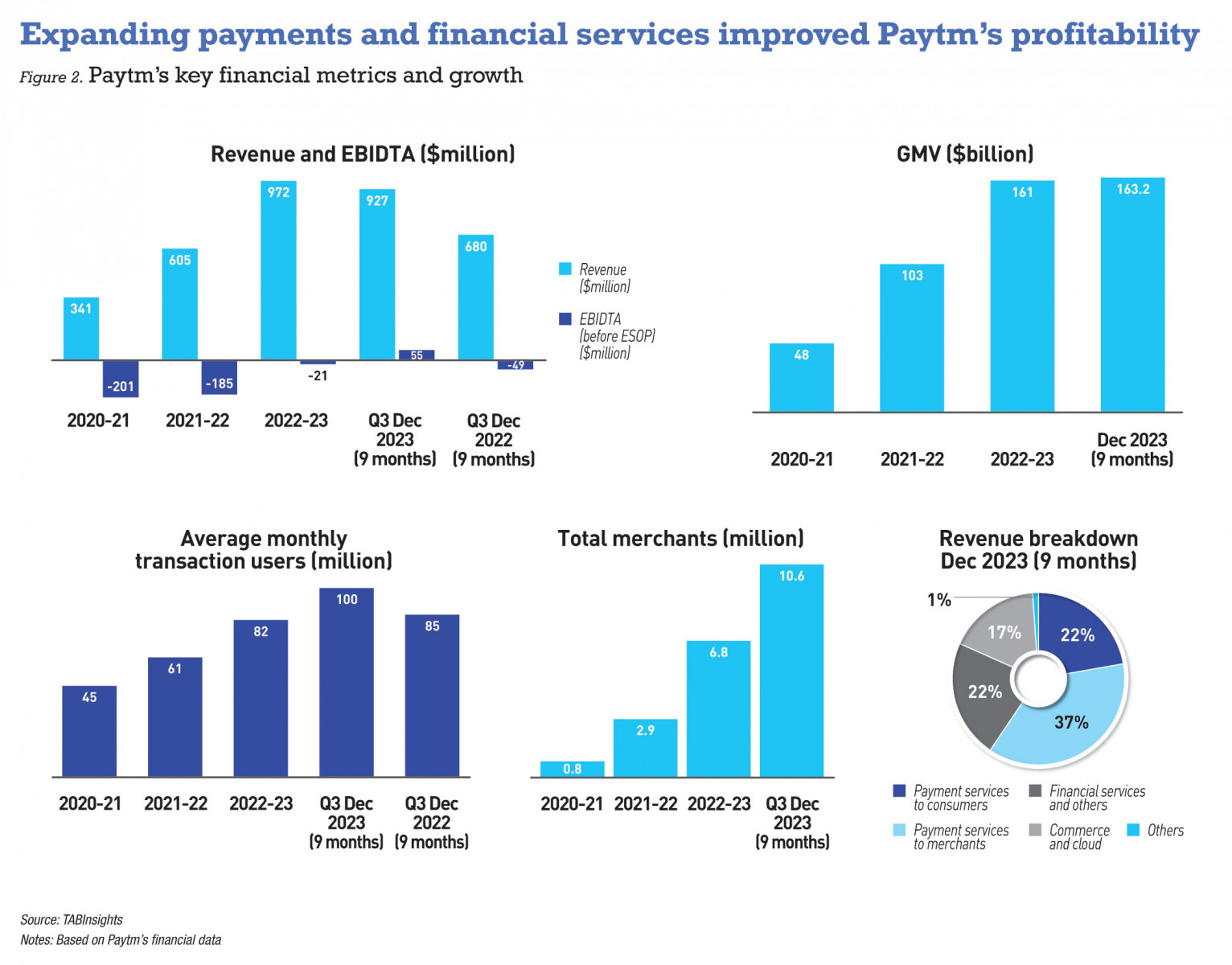

Paytm reported gross merchandise value at $163 billion as of end December 2023. The company’s business model has been a roller coaster ride. It now has 39.3 million merchants and 100 million monthly transacting users.

Launched in 2010, it attracted customers with its digital wallet, expanding into e-commerce, online payments, bill payments, and ticketing. India's demonetisation in 2016 accelerated Paytm’s growth with over 100 million downloads within a year. Paytm expanded into PPB, Paytm Mall, gold sales and payment methods through quick response (QR) and India’s Unified Payments Interface (UPI).

PPB obtained its payment bank licence in 2017. Payment banks operate with limited banking operations. They have a maximum deposit of INR 200,000 ($2,408) per customer but no lending bandwith, curtailing revenue options.

RBI issued 11 in-principle payment bank licences eight years ago, but only six are in operation. PPB partnered with third-party banks for parking deposits and with parent Paytm to enable payments and banking services across merchant networks.

Paytm strategically expanded its financial services with loans distribution, credit cards, buy- now-pay-later, and merchant services through devices, and soundbox for audio payment confirmation. These initiatives improved margins, leading to operational profitability in 2023.

Paytm generates revenue from three main sources: merchant commission and subscription, merchant discount rates and platform fees. This included wallet services and merchant discount rate through its banking associate PPB. It also partners with banks and non-banking financial companies (NBFCs) for loan distribution, and offers commerce services, co-branded credit cards, loyalty programmes, and advertising. In 2023, the company managed to touch operational profitability with its growing financial services business. Payments contributed close to 60% of its revenue.

Impact of latest regulation on Paytm’s business

RBI’s latest disciplinary action threatens PPB’s existence and banking licence, prompting a reduction in its wallet and payment business.

RBI clarified that the regulation is on PPB. The Paytm payment app will be allowed to continue its services in partnership with third-party banks.

Paytm stated: “Going forward, we will be working only with other banks, and not with the PPB. The next phase of our journey is to continue to expand our payments and financial services business, only in partnerships with other banks.”

Yet, the overall impact on its bottom line will be significant. Paytm stated: “Depending on the nature of the resolution, we expect this action to have a worst-case impact of INR 3,000 million to INR 5,000 million ($36 million to $60 million) on our annual earnings before interest, taxes, depreciation, and amortisation.”

Paytm’s linkages with PPB have led to a loss of its wallet business and a disruption in merchant payment business. With 40 million merchants, Paytm needs to migrate merchant relationships to other third-party banks, and dismantle links to PPB accounts.

Following the regulation, Paytm has moved its nodal accounts to Axis Bank, ensuring continuity of Paytm QR, soundbox, and card machine services for merchants.

For UPI service, Paytm already partners with other banks and will need to transition millions of merchant services to third-party banks. The migration journey is unclear and the account-to-account migration is time consuming. For a one-time migration, guidance is needed from RBI and National Payments Corporation of India authorities.

An estimated 10% to 15% of Paytm's merchant loans have repayment through PPB. These will need to be moved to a third-party bank and satisfy the regulatory compliance and governance requirements of the third parties. In the meantime, new loan originations will suffer for the next few weeks.

Paytm had pared down its low-value loans, following the revised risk weightage rules on unsecured loans from the regulator in 2023. Paytm’s management of these various operational transitions remains to be seen and it’s unclear if PPB will be able to keep its licence or if restrictions will be lifted.

The migration from PPB to third-party banks will erode Paytm’s competitive advantage, narrowing the gap with its competitors. These strategic changes will alter Paytm’s trajectory, and significantly pivot the attention of the fintech industry to the importance of legal compliance.