Banks in this year’s Excellence Programme generated record earnings in retail banking, particularly in mature markets in Asia. However, the industry has also seen rising cost of funds and a deterioration in credit book quality, including in small-business banking, driven by sustained higher interest rates and weaknesses in the global economy.

Despite these headwinds, banks have doubled down on creating an improved digital and mobile user experience, racing towards the adoption of GenAI, and advanced the open banking agenda around platforming and embedded finance.

New in this year’s programme is a growing interest in green financial lifestyle offerings to reduce the customer’s carbon footprint. Fraud mitigation and preven- tion continues to be a key focus area but this year, the emphasis is shifting towards proactive fraud and scam prevention, along with real-time fraud alerts.

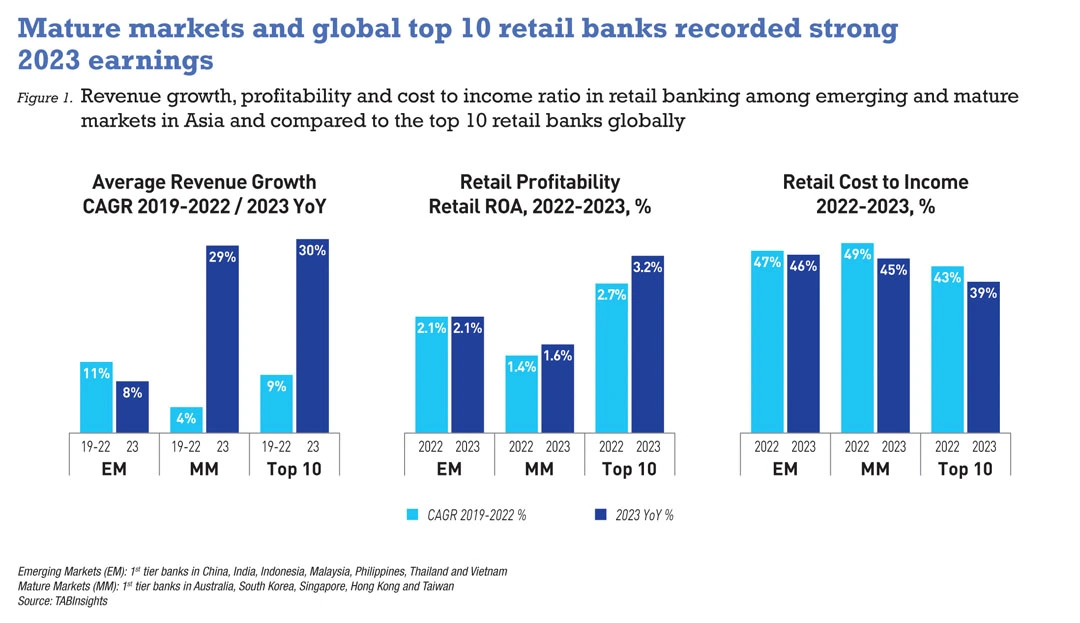

Mixed performance between mature and emerging retail markets in Asia

Higher interest rates boosted net interest margins and profitability for most mature retail banking markets in Asia and the global top 10 retail banks in 2023. Credit consumption was stable in 2023, while top-line retail banking revenue in mature markets grew 29% YoY. Return on equity and cost-to-income ratios improved.

Emerging markets (EM) had a tougher operating environment and saw growth slow from 2019 to 2022. Retail banking revenue slowed to 8% YoY in China, Vietnam, Thailand, and Indonesia.

China’s retail banking market is facing its fourth consecutive year of market downturn, mainly influenced by a shrinking real estate market. China’s retail banking sector faces regulatory and macroeconomic pressures that are lowering revenues and profits. Banks are turning to AI and also a greater focus on personalised services to boost growth and customer engagement. Slowing property sales and construction have reduced the need for mortgage lending and associated financial services, which weighs heavily on the retail banking segment. Retail sales of consumer goods in China touched an all- time low this year, dropping from 18.4% YoY in April 2023 to 2.0% in June 2024.

Overall, banks in Asia remain cautious due to rising credit risks and deposit costs amid economic uncertainties. Banks have also been facing tightening liquidity. To mitigate risks, banks have focused on low- cost deposits, with many leading banks achieving a current account and savings account ratio above 40% in 2023.

Rising consumer finance and non-performing loans (NPLs) for small and medium-sized enterprises (SMEs) remain a major concern. The SME NPL ratio rose in South Korea, Indonesia, and Malaysia, but remained highest in India and Thailand at 6.8% and 7.2%, respectively. However, 2024 interest-rate cuts and SME lending support policies should boost growth and reduce NPLs.

Consumer finance -- unsecured loans like credit cards and personal loans -- varies widely across Asian markets. It makes up 6% to 49% of retail lending, with Indone- sia, the Philippines, and South Korea ac- counting for over 40%. With 20% and 19% compound annual growth rates, India and the Philippines had the strongest consumer finance growth between 2019 and 2023.

Due to economic reopening, strong growth, and easier digital credit access, consumer finance in the Philippines rose from 31% of retail lending in 2019 to 45% in 2023. Digital banks in the Philippines are worried about credit quality, with gross NPL rising from 6.1% in June 2023 to 20.6% in May 2024.

Focus on user engagement and experience

Customer experience and engagement are being prioritised by banks. The goal is to make mobile banking apps more intuitive, seamless, and user-friendly. Banks em- phasise engagement to sustain cross-sell ratios. With digital-native user rates above 50% for leading players, the focus is now on engaging customers beyond account management to provide a more complete and satisfying banking experience. Leading banks have monthly log-ins per active user above 14, indicating high engagement.

GenAI adoption and issues

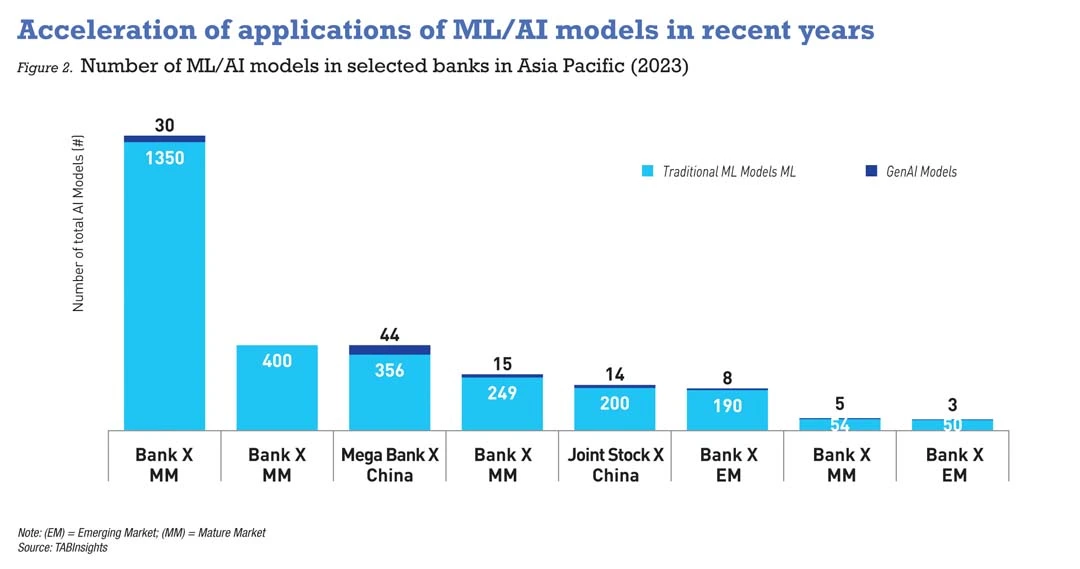

Asian banks are cautiously adopting Ge- nAI, focussing on quick wins and internal use cases, with China leading in adoption. GenAI is still young, with over 90% of bank AI models being discriminatory and ML- based. Further machine learning (ML) and adaptation are expected in 2024.

Most first-tier mega and joint-stock banks have LLMs in production. Leading Asian Pacific banks like OCBC in Singapore and CommBank in Australia are growing.

AI made four million decisions per day in 2023, and 12 million by 2025, according to OCBC. With $841 billion in assets, Com- mBank’s AI makes 35 million decisions daily.

However, most banks use outdated IT and data structures, requiring a strong data foundation and advanced analytics to scale AI. Retail banks have 30 to 400 AI and ML models, most of which are standard. GenAI is still a small AI application. Most GenAI use cases will launch in emerging markets in late 2024 and 2025.

By late 2023 and early 2024, banks prioritised infrastructure and LLM model quality. Banks with strong model manage- ment infrastructure (MLOps/LLMOps) and model risk and governance frameworks can adapt GenAI better.

Banks use GenAI to create customer relationship manager copilots, improve call centres, and assist software developers to boost productivity, risk management, and revenue. GenAI, whether open-source or big tech, has been widely recognised for simplifying daily tasks. GenAI’s main benefit is timely, accurate information to improve financial decision-making and strategy. GenAI must provide better per- sonalised experiences, not just segments or micro segments, to benefit end users.

Banking platforms and embedded finance

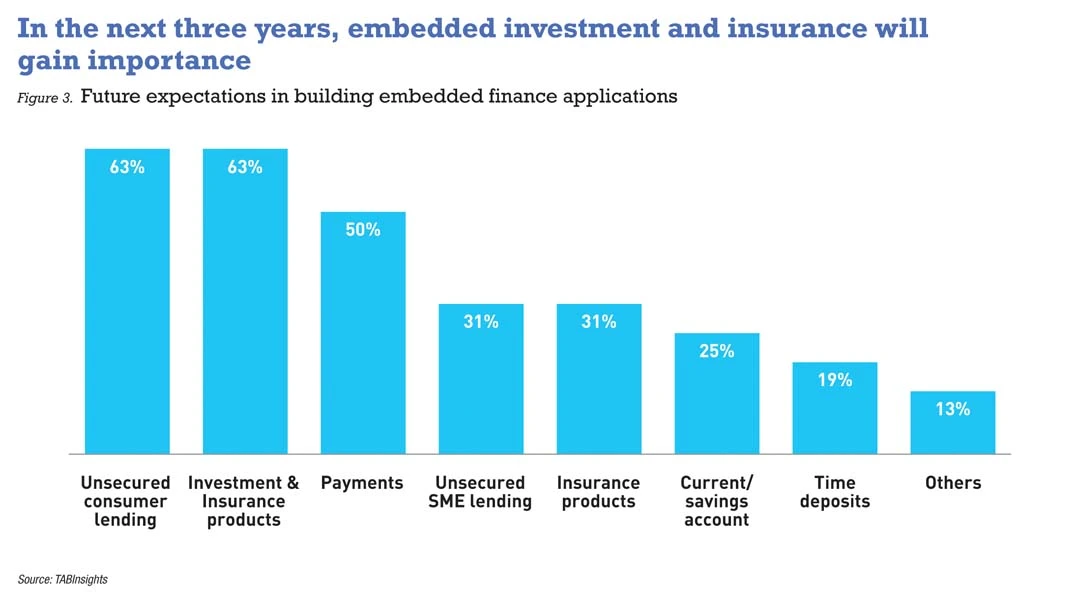

Banks are increasingly envisioning retail banking ecosystems that include core services like credit and payments and non- core services like healthcare and ticketing. Future retail banking is a well-orchestrated mix of integrated products and services in one place.

TABInsights found that 69% of banks had embedded finance services at partner sites in 2023. Payments and unsecured lending are the most popular embedded finance services. E-commerce and other marketplaces are boosting collateral-free consumer financing, albeit slowly. Banks are also using third-party transaction data to create alternative credit scoring models. Executives expect embedded investment and insurance to grow in the next three years. While only 19% of banks currently use third-party banking-as-a-service, 82% plan to do so in the future.

Growing green financial lifestyle options

Another trend is banks offering green financial lifestyles to encourage eco- friendly behaviour. Rewarding eco- friendly behaviours like public transport, recycling, and buying sustainable brands reduces carbon footprints.

This mechanism relies on customer spending on cards or digital wallets, carbon footprint tracking, and incentives like recycled plastic cards or tree-planting. Ironically, most financial institutions still reward high-carbon activities like flying and refuelling. As consumer awareness grows, a bank’s commitment to climate change and environmental sustainability may influence customers’ banking choices.

Moving towards real time fraud detection

In 2023, Asia Pacific scored the dubious honour of topping the list for financial fraud losses. Financial fraud in the re- gion totalled $207.2 billion, according to the 2024 Global Financial Crime Report, followed by the Americas with $137.2 bil- lion, and Europe, Middle East and Africa with $97.6 billion. Payment fraud is the leading cause of losses across all regions, especially in Asia Pacific, where it amounts to $190.2 billion.

Banks in Asia encounter significant ob- stacles in effectively combating fraud, pri- marily due to the limitations of traditional rule-based fraud detection systems and organisational fragmentation. In response to these challenges, the banking industry is undergoing a significant shift in its ap- proach. Banks are prioritising real-time fraud detection to combat increasingly sophisticated and fast-moving schemes. Real-time fraud prevention systems now process significantly higher transaction volumes, with peak capacity reaching up to 1,000 transactions per second.

Outlook dependant on high interest rates

In 2023, rising interest rates boosted top line growth and earnings for banks, espe- cially in mature Asian markets. Singapore, Australia, Hong Kong, Taiwan, and South Korea have fared better than many Asia Pacific EMs despite higher credit costs.

Retail banking depends on whether those markets keep high interest rates. High rates could raise credit costs and lower loan quality. Global monetary poli- cies and their effects on local economies will affect these banks’ performance.

Banks would do well with a continued fo- cus on improving digital experiences, includ- ing scaled personalisation, GenAI, and open banking, to position the industry for growth despite macroeconomic uncertainties.